130+ Best Venture Capital (VC) Firms That Invest In Foodtech Startups

The food industry is on a plate for change, and your innovative foodtech startup holds the fork. Venture capital (VC) firms are your secret ingredient, specializing in fueling promising ventures. This comprehensive list unveils over 130 top VC firms hungry to invest in foodtech. Get ready to find the perfect partner and watch your foodtech startup become the next big thing.

Amplify LA

Amplify LA, founded in 2011 and based in Los Angeles, California, is a pre-seed fund dedicated to supporting strong startups at the earliest stages of their journey. They specialize in making early-stage investments in technology, e-commerce, mobile, healthcare, fintech, gaming, enterprise, and SaaS. Amplify is known for backing LA startups and is a prominent player in the Los Angeles technology scene.

Headquarters: United States

Investment Geography: USA

Operating since: 2011

Stages: Pre-Seed, Seed

Investment Focus: B2B/Enterprise Software, Consumer Products, Consumer Services, FinTech, CyberSecurity, Blockchain, eSports, Gaming, E-commerce, Retail, Fashion, Digital Health, HealthTech, FoodTech, HRTech, Automobile, Marketplaces

Number of investments: 158

Number of exits: 51

Check size: $100k – $10 million

Notable investments: Cascade, Fleet Defender

Founders/Key People: Paul Bricault, Oded Noy

Website: http://amplify.la

Animo Ventures

Animo Ventures is a VC firm that specializes in seed investments across the United States. They are usually the first to back companies from the ideation phase to early traction. The firm primarily invests across the United States, with a focus on sectors such as enterprise, fintech, digital health, B2C/e-commerce, and AI/dev tools. Their investment strategy is both dynamic and aggressive, as they typically invest between $500,000 and $2.5 million in early-stage enterprises. This demonstrates their dedication to nurturing startups and helping them scale.

Headquarters: USA

Investment Geography: USA, Canada, UK

Operating since: 2018

Stages: Pre-Seed, Seed

Investment Focus: Industry Agnostic (B2B/Enterprise, B2C/Consumer, Enterprise Software, Cloud Computing, FinTech, Digital Health, Consumer Products/D2C, FoodTech, Marketplaces)

Number of investments: 68

Number of exits: 6

Check size: $500k – $2.5m

Notable investments: Sage, Codi, Lev

Founders/Key People: Nico Berardi, Antonio Osio

Website: https://animo.vc

Artesian Capital Management

Artesian Capital Management, founded in 2004 by Jeremy Colless, Matthew Clunies-Ross, and John McCartney, is a global alternative investment management firm based in Sydney, Australia. They specialize in public and private debt, venture capital, and impact investment strategies. The firm is known for its Venture Capital as a Service (VCaaS) solutions, catering to governments, corporations, and industry groups. With over $1.1 billion in assets under management (AUM), Artesian operates offices in Australia, China, Indonesia, Singapore, the UK, and the US. Their investment focus includes areas such as agri-food, health, AI, robotics, and education, primarily targeting early-stage ventures.

Headquarters: Australia

Investment Geography: Australia, USA, China, Singapore, India, Canada, Hong Kong, UK, Germany, Taiwan, Japan, Kenya, South Korea, Senegal, Israel, Belgium, Mexico, Brazil, Spain, Portugal

Operating since: 2004

Stages: Seed, Series A

Investment Focus: Software/Hardware (AgriFood/AgTech/FoodTech, Clean Energy/CleanTech, AI/Robotics, MedTech/Medical Devices)

Number of investments: 722

Number of exits: 186

Check size: $50k – $1m

Notable investments: Fleet Space Technologies, TurtleTree

Founders/Key People: Jeremy Colless, Matthew Clunies-Ross, John McCartney

Website: https://www.artesianinvest.com/overview-vc

ARTIS Ventures

ARTIS Ventures, founded in 2001 and based in San Francisco, California, specializes in pioneering investments at the intersection of life sciences and computer sciences, a niche known as TechBio. They have a track record of over a decade in supporting market-defining companies to reshape and reinvent industries. The firm is known for investing in early-stage and late-stage companies. ARTIS Ventures primarily invests in companies based in the United States.

Headquarters: USA

Investment Geography: USA, UK, Germany

Operating since: 2001

Stages: Seed, Series A, Series B

Investment Focus: TechBio (BioTech, Diagnostics, AI, MedTech, Data Analytics, Advanced Materials, FoodTech, Enterprise Software, HealthTech, Digital Health), Tech (Digital Media, Cloud Computing, ML, CyberSecurity, Data Storage, Semiconductors, FinTech, MR, SpaceTech, Marketplaces, Business Intelligence, FoodTech)

Number of investments: 128

Number of exits: 38

Check size: $500k – $10m

Notable investments: Palantir Technologies, YouTube

Founders/Key People: Stuart Peterson, Vasudev Bailey

Website: https://www.av.co

B2venture

b2venture is a venture capital firm with a knack for nurturing early-stage companies. They’re big on investing in the early stages of a company’s life, spotting potential early and helping it grow. They’ve got a strong network of angel investors. This network spans tech and industry, bringing expertise and hands-on support to the companies they invest in.

Headquarters: Germany

Investment Geography: USA, UK, Israel, Germany, Canada, Netherlands, Brazil, China, Switzerland, Mexico, Spain, Austria, Sweden, Italy, France, India, Finland, Turkey, Belgium, Japan, Malta, Poland, Ireland, Portugal, Australia

Operating since: 2000

Stages: Seed, Series A, Series B

Investment Focus: Digital Tech (Enterprise Software, Cloud Infrastructure, E-commerce, Logistics, TravelTech, Fashion, FoodTech, AI, ML, Data Analytics, Social Network, Digital Health, JobTech, CyberSecurity, Mobility, FinTech, Sports, EdTech, PropTech, LegalTech, Marketplaces), Industrial Tech (Industry 4.0, Resource Efficiency, Industrial AI, IoT, Enterprise Software, MedTech)

Number of investments: 356

Number of exits: 128

Check size: $250k – $5m

Notable investments: OrCam, AI21, XING

Founders/Key People: Chase Gummer, Jochen Gutbrod

Website: https://www.b2venture.vc/

BackBone Ventures

BackBone Ventures, founded in 2018, is an early-stage venture capital firm based in Zurich The firm has made a significant impact in a short time, with 40+ investments and six successful exits already. BackBone Ventures focuses on supporting outstanding entrepreneurs in Germany and Switzerland. The firm prides itself on backing founders who create innovative and disruptive companies using their expertise and capital to boost growth and create next-generation success stories.

Headquarters: Switzerland

Investment Geography: Switzerland, Germany, Israel, India, Turkey, Mexico, Austria

Operating since: 2018

Stages: Seed, Series A

Investment Focus: ICT, AI, ML, Data Analytics, SaaS, FinTech, CyberSecurity, LegalTech, BioTech, FoodTech, Biopharma, HealthTech, Disruptive Tech, Drones

Number of investments: 44

Number of exits: 6

Check size: $100k – $5m

Notable investments: Spyce, Flytrex

Founders/Key People: Philippe Bernet, Miklos Stanek

Website: https://www.backbone.vc

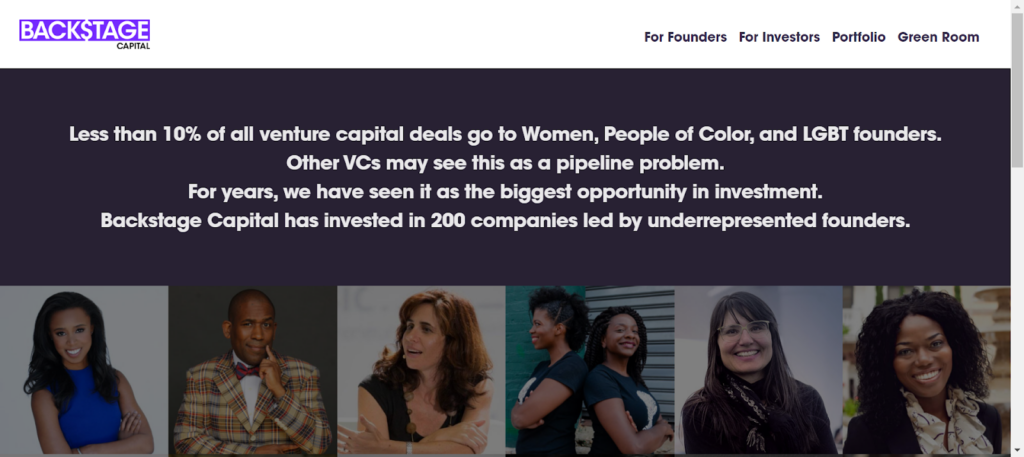

Backstage Capital

Backstage Capital is a venture capital firm that invests in startups led by underrepresented founders, including women, people of color, and LGBTQ+ founders. The firm is dedicated to reducing funding disparities in technology by supporting high-potential founders from these groups. Backstage Capital primarily invests in pre-seed and seed-stage startups. Regarding investment amounts, Backstage Capital has been investing amounts ranging from $25,000 to $100,000 in companies with diverse founders.

Headquarters: USA

Investment Geography: USA, UK, Canada

Operating since: 2015

Stages: Pre-Seed, Seed, Series A

Investment Focus: Underrepresented Founders (Women, People of Color, LGBTQ): (Software, Enterprise/B2B, Blockchain, FinTech, EdTech, Consumer Tech, Consumer Goods, DTC, E-commerce, FoodTech, Gaming, Digital Health, Digital Media, SaaS, Marketplaces)

Number of investments: 205

Number of exits: 43

Check size: $25k – $100k

Notable investments: Dollaride, Hello Alice, Fairly AI

Founders/Key People: Arlan Hamilton, Christie Pitts

Website: https://backstagecapital.com

Balderton Capital

Balderton Capital specializes in early-stage, technology, and internet startup investments in Europe. Founded in 2000 as Benchmark Capital Europe, Balderton Capital became fully independent in 2007. The firm is one of London’s four biggest VC firms and is Europe’s leading venture capital investor, focusing exclusively on European-founded tech startups. Balderton Capital is a key player in the European VC landscape, with over $4.5 billion raised to invest in European technology and backing over 250 companies since 2000.

Headquarters: UK

Investment Geography: USA, UK, Canada, Germany, France, Sweden, Ireland, Switzerland, Netherlands, Denmark, Finland, China, Spain, Israel, Turkey, Burma (Myanmar), Austria, Russia, Jersey, Italy, Norway, Hong Kong, Nigeria, Singapore, Mexico.

Operating since: 2000

Stages: Seed, Series A, Series B

Investment Focus: Open Finance/FinTech, Data-driven Health/HealthTech, Enterprise/B2B Software, Efficient Mobility, CyberSecurity, RetailTech, Thoughtful Food/FoodTech, Creative Entertainment

Number of investments: 467

Number of exits: 154

Check size: $1m – $25m

Notable investments: Cleo, Truecaller

Founders/Key People: Bernard Liautaud, Greta Anderson

Website: https://www.balderton.com

Baseline Ventures

Baseline Ventures is a VC firm specializing in seed and growth-stage investments in tech. Founded in 2006 by Steve Anderson in San Francisco, California, the firm has been instrumental as the first seed investor in Instagram and an early investor in Twitter. Baseline Ventures is celebrated as one of Silicon Valley’s most successful and smallest investment firms. In terms of investment check size, Baseline Ventures offers checks based on the stage and needs of the startup. Their check sizes range from as low as $0 to $100K, going up to between $100K and $500K, and even as high as $500K to $1M.

Headquarters: USA

Investment Geography: USA, Australia, Canada, Germany

Operating since: 2006

Stages: Seed, Series A

Investment Focus: FinTech, Enterprise/B2B Software, SaaS, CyberSecurity, Robotics, Mobile, Consumer Services, Digital Health, EdTech, Fashion, E-commerce, FoodTech, Gaming, Social, Marketplaces

Number of investments: 238

Number of exits: 102

Check size: $10k – $1m

Notable investments: SoFi, Instagram, Twitter

Founders/Key People: Steve Anderson,

Website: https://www.baselinev.com

Beco Capital

BECO Capital is a prominent VC firm based in Dubai, United Arab Emirates. It is one of the first VC firms founded in the UAE, focusing on the Middle East and North Africa (MENA) region. BECO Capital has become one of the largest non-governmental venture firms in the region, boasting approximately $450 million in assets under management. BECO Capital provides growth capital and hands-on operational mentorship to its portfolio companies, fostering their development and scaling in the MENA market.

Headquarters: UAE

Investment Geography: UAE, USA, UK, France, Egypt, Saudi Arabia, Singapore, Kuwait, Turkey, Jordan, Germany, Bahrain, Canada

Operating since: 2012

Stages: Late Seed, Pre-Series A, Series A

Investment Focus: Enterprise Software, PropTech, FinTech, InsurTech, HRTech, Mobility, Transportation, Marketplaces, eSports, E-commerce, CyberSecurity, HealthTech, FoodTech, AR/VR, Construction

Number of investments: 98

Number of exits: 17

Check size: $10-50m

Notable investments: Tribal, Careem

Founders/Key People: Abdulaziz Shikh Al Sagha, Dany Farha

Website: https://becocapital.com

BEENEXT

BEENEXT is a venture capital firm founded in 2015 based in Singapore. The firm primarily focuses on investments in startups from India, Southeast Asia, Japan, and the USA. BEENEXT is particularly interested in tech startups in sectors like the marketplace, Analytics, EdTech, fintech, AI, data, SaaS, IoT, healthcare, and agritech.

Headquarters: Singapore

Investment Geography: Singapore, USA, India, Indonesia, Singapore, Japan, Philippines, Vietnam, Pakistan, Turkey, Myanmar, Nigeria

Operating since: 2015

Stages: Seed, Series A

Investment Focus: AgriTech, AI, Analytics, Cloud Kitchen, EdTech, Enterprise SaaS, FinTech, FoodTech, Gaming, Geotagging, HealthTech, HRTech, IoT, Lifestyle, Logistics, Marketplace, Media, Mobility, PropTech, Real Estate, Satellite, Sustainability

Number of investments: 418

Number of exits: 35

Check size: $100k-$10m

Notable investments: 90 Seconds, 42 Cards

Founders/Key People: Teruhide Sato, Dirk Van Quaquebeke

Website: https://www.beenext.com

Begin Capital

Begin Capital is a VC firm based in London, UK. The firm is focused on investing in the technology sector across Europe. Begin Capital’s approach is dedicated to DeepTech, Artificial Intelligence, and SaaS. The firm offers early-stage investment and hands-on advice to entrepreneurs, supporting them in building global businesses. Begin Capital has a history of investing in successful companies, demonstrating its commitment to nurturing and scaling startups with potential.

Headquarters: UK

Investment Geography: USA, UK, France

Operating since: 2019

Stages: Seed, Series A

Investment Focus: Artificial Intelligence, Software, Social Networks, SaaS, CyberSecurity, EdTech, FoodTech, Marketplaces

Number of investments: 21

Number of exits: 4

Check size: $1.5m – 2m

Notable investments: Middleware, Uncrowd

Founders/Key People: Alex Menn, Ruslan Sarkisyan

Website: https://www.begincl.com

BFG Partners

BFG Partners specializes in early-stage investments in the food, beverage, and consumer products sectors, with a particular emphasis on companies that are better for the environment and communities. BFG Partners looks to invest in disruptive brands with exceptional products and thoughtful strategies. They prefer to partner with organizations that positively impact the environment and their communities, both locally and globally.

Headquarters: USA

Investment Geography: USA, Canada

Operating since: 2014

Stages: Seed, Series A, Series B

Investment Focus: Consumer Products, Consumer Brands, DTC (Food & Beverage/FoodTech, Personal Care, Home Goods, Dietary Supplements, Software for Consumer Brands)

Number of investments: 48

Number of exits: 9

Check size: $1m – $10m

Notable investments: Stay Ai, Quinn

Founders/Key People: Dayton Miller, Tyler Morgan

Website: https://bfgpartners.com

Big Basin Capital

Big Basin Capital is a venture capital firm located in Silicon Valley, primarily investing in early-stage startups in South Korea and the United States. The firm strongly focuses on Korean startups, leveraging the country’s rapidly growing tech environment and highly-educated talent pool. They often act as the first institutional investor in a startup and are known to lead deals or co-invest with other VCs. The firm’s investment strategy also includes board participation to provide hands-on guidance and assistance to its portfolio companies.

Headquarters: USA

Investment Geography: USA, France, South Korea, Singapore

Operating since: 2013

Stages: Seed, Series A

Investment Focus: Consumer Services, DTC, E-commerce, FoodTech, Digital Media, EdTech, Enterprise Software, Logistics, HR, BioTech

Number of investments: 81

Number of exits: 11

Check size: $500k – $2m

Notable investments: GoodTime.io, GOPIZZA,

Founders/Key People: Phil K. Yoon, Taekkyung Lee

Website: https://www.bigbasincapital.com

Blackbird Ventures

Since its inception in 2012, Blackbird has demonstrated a strong commitment to supporting startups throughout their journey from idea to beyond IPO. The firm’s portfolio is notable, worth over $7 billion, and includes some of the most successful startups from Australia and New Zealand, such as Canva, Zoox, SafetyCulture, and Culture Amp. Blackbird Ventures focuses on backing generational ambition with generational belief, a philosophy that extends to its approach to investment. They have backed over 100 companies across Australia and New Zealand, with 20% now worth over $100 million and six valued at over $1 billion.

Headquarters: Australia

Investment Geography: USA, New Zealand, UK, Hong Kong

Operating since: 2012

Stages: Pre-Seed, Seed, Series A, Series B

Investment Focus: Consumer Tech, Consumer Brands, D2C, FoodTech, AgTech, FinTech, Crypto, EdTech, E-commerce, Marketplace, Enterprise Software, Cloud, HRTech, MarTech, RetailTech, CyberSecurity, Databases, Synthetic Biology, BioTech, MedTech, Digital Health, HealthTech, Robotics, IoT, Autonomous, SpaceTech, Semiconductors, Solar

Number of investments: 246

Number of exits: 23

Check size: $25k – $5m

Notable investments: Canva, Zoox

Founders/Key People: Alex Gifford, James Palmer

Website: https://www.blackbird.vc

Bow Capital

Bow Capital is an innovative venture capital firm that blends academia, business, and entertainment in its investment approach. Primarily, Bow Capital focuses on early-stage investments, particularly in Series A and B rounds, demonstrating a commitment to nurturing emerging technologies and business models. The firm was founded in partnership with the University of California, showcasing a commitment to integrating academic research and innovation into the VC landscape.

Headquarters: USA

Investment Geography: USA, Canada

Operating since: 2016

Stages: Series A, Series B

Investment Focus: CONSUMER, E-commerce, DTC, EdTech, ENTERPRISE, Software, Data Analytics, Logistics, Science, BioTech, FoodTech, AgTech, CleanTech, Consumer and B2B Marketplaces

Number of investments: 63

Number of exits: 9

Check size: $500k – $10m

Notable investments: ClearCo, Evolve BioSystems

Founders/Key People: Grady Burnett, Raymond Dong

Website: https://bowcapital.com

Breega Capital

Breega Capital is a venture capital firm that’s all about supporting tech startups in Europe. They’re active in the European Union, Middle East, and Africa regions. They get hands-on, providing industry and operational expertise and helping their portfolio companies grow internationally. They’re especially keen on European tech startups at the Seed to Series A stage.

Headquarters: France

Investment Geography: France, USA, UK, Israel, Germany, Brazil, Spain, Kenya, UAE, Portugal, Uganda, South Africa, Senegal

Operating since: 2013

Stages: Seed, Series A

Investment Focus: AdTech, AgTech, Blockchain, BPO, DeepTech, EdTech, FinTech, FoodTech, HealthTech, HRTech, InsurTech, IoT, Marketplace, MarTech, RegTech, SaaS, SaaS-AI, Social Networks, Software, Marketplaces, Robotics, High Tech Hardware

Number of investments: 149

Number of exits: 53

Check size: $500k – $12m

Notable investments: Exotec, Curve

Founders/Key People: Ben Marrel, Maximilien Bacot

Website: https://www.breega.com

BY Venture Partners

BY Venture Partners, previously known as B&Y Venture Partners, plays a crucial role in bridging the MENA region’s rising tech ecosystem with established tech hubs in mature markets. Their strategic position enables them to assist MENA startups in achieving global presence while helping international companies expand into the MENA region. The firm focuses on investing in high-impact founders who are building market-transforming and category-leading companies.

Headquarters: Jersey

Investment Geography: USA, UK, UAE, Lebanon, Pakistan, Egypt, Sweden, Switzerland, Saudi Arabia, Spain

Operating since: 2015

Stages: Seed, Series A, Series B

Investment Focus: Big Data & Analytics, E-commerce, Gaming, HealthTech, Online Marketplaces, FinTech, Cyber Security, SaaS, Direct to Consumer, Enterprise Software, FoodTech, Property Tech

Number of investments: 95

Number of exits: 19

Check size: $250k – $10m

Notable investments: Onfido, Monito, Ro

Founders/Key People: Abdallah Yafi, Ghaith Yafi

Website: https://byvp.com

Cento Ventures

Cento Ventures is a venture capital firm based in Singapore that was established in 2011. This firm invests in Southeast Asian digital and technology sectors, particularly Malaysia, Thailand, Singapore, Indonesia, the Philippines, and Vietnam. Known for its focus on under-invested emerging digital markets, Cento Ventures seeks companies that blend local insights with proven digital business models. The firm typically invests in Series A startups with 1-2 years of operating experience in Southeast Asia’s emerging markets.

Headquarters: Singapore

Investment Geography: Singapore, Thailand, Malaysia, UK, USA, Vietnam, Indonesia, Philippines

Operating since: 2011

Stages: Series A, Series B

Investment Focus: Enterprise Software, AI, FinTech, InsurTech, E-commerce, Fashion, RetailTech, Digital Consumer Services, Consumer Internet, FoodTech, AdTech, JobTech, Digital Media, Digital Entertainment, Marketplaces

Number of investments: 39

Number of exits: 13

Check size: $5m – $10m

Notable investments: Pomelo, Foodpanda

Founders/Key People: Lee Buckerfield, Ali Fancy

Website: https://www.cento.vc

Centripetal Capital Partners

Centripetal Capital Partners was founded in 2004 and is based in Stamford, Connecticut. The firm invests in tech, health & wellness sectors, and market reimagination. Known for its innovative fund structure, the firm offers greater flexibility and opportunity for limited partners compared to traditional funds.

Headquarters: USA

Investment Geography: USA, Sweden, Australia, Denmark

Operating since: 2004

Stages: Seed, Series A, Series B

Investment Focus: Health & Wellness, Animal Health, Nutrition, Pharma, BioTech, Manufacturing, New Materials, Retail, FoodTech, Enterprise Software, AdTech, MediaTech, AI

Number of investments: 26

Number of exits: 12

Check size: $2m – $7m

Notable investments: Ageras, Quartr

Founders/Key People: Jeff Brodlieb, Stephen Rossetter

Website: https://www.centricap.com

Champion Hill Ventures

Champion Hill Ventures, established in 2014, is headquartered in Raleigh, North Carolina. The firm invests in early-stage technology companies, focusing on non-consensus ideas, markets, founders, and technologies. It operates across the United States and occasionally in other regions. Champion Hill Ventures invests in various technology sectors, including AI, cybersecurity, data analytics, and digital health.

Headquarters: USA

Investment Geography: USA, UK, Singapore, Switzerland

Operating since: 2014

Stages: Seed, Series A

Investment Focus: AR, AI, ML, Deep Learning, Gaming, Defense, SpaceTech, Satellites, Enterprise Software, FoodTech, BioTech, Health Care, HealthTech, CleanTech, Mobile, Robotics, Freight, Hardware, Wireless, EnergyTech

Number of investments: 28

Number of exits: 4

Check size: $100k – $10m

Notable investments: SpaceX, Osaro

Founders/Key People: Josh Manchester,

Website: https://www.championhillventures.com

Cherry Ventures

Cherry Ventures, founded in 2012, is based in Berlin, Germany. The firm predominantly invests in pre-seed and seed-stage startups in various sectors, including climate tech, consumer, fintech, health tech, industrials, interactive entertainment, lifestyle, mobility, and SaaS. Cherry Ventures is led by a team of entrepreneurs with experience in building fast-scaling companies like Zalando and Spotify.

Headquarters: Germany

Investment Geography: Germany, USA, UK, Singapore, Switzerland, Sweden, Austria, Denmark, France, Finland, UAE, Indonesia, Israel, Poland, Australia, Spain, Netherlands

Operating since: 2012

Stages: Pre-Seed, Seed, Series A

Investment Focus: Consumer, FinTech, HealthTech, Industry 4.0, Enterprise, Lifestyle, Mobility, SaaS, TravelTech, FoodTech, AgTech, Logistics, Marketplaces

Number of investments: 232

Number of exits: 41

Check size: $300k – $3m

Notable investments: InFarm, Flink,

Founders/Key People: Christian Meermann, Filip Dames

Website: https://www.cherry.vc

Chloe Capital

Chloe Capital was established in 2017 and is based in New York. The firm invests in women-led companies in the technology sector, committed to advancing entrepreneurship and closing the gender and diversity gap. It is a seed-stage venture capital firm and is sector-agnostic. Chloe Capital likes to lead seed rounds of $1.5m to $3m, with an average check size of $900k.

Headquarters: USA

Investment Geography: USA, Israel

Operating since: 2017

Stages: Pre-Seed, Seed

Investment Focus: Female Founders (Future of Work & Education, EdTech, SaaS, HRTech, Blockchain, AI, VR/AR, IoT, CleanTech, FoodTech, AgTech, Hardware, Wearables, Robotics, Marketplaces)

Number of investments: 50

Number of exits: 10

Check size: $400k – $1m

Notable investments: NODE, Figur8

Founders/Key People: Erica O’Brian, Kathryn Cartini

Website: https://chloecapital.com

Cleo Capital

Cleo Capital, established in 2018, is based in California. The firm focuses on seed-stage venture capital investments, primarily in technology and technology-enabled sectors. Cleo Capital typically invests in pre-seed and seed rounds, focusing on under-represented founders, fintech, consumer, and enterprise sectors. The firm operates mainly in the USA, with smaller investments in Canada and India.

Headquarters: USA

Investment Geography: USA, Canada, India

Operating since: 2018

Stages: Pre-Seed, Seed

Investment Focus: Female Founders (Consumer Products, D2C, E-commerce, Fashion, Beauty, Luxury, FoodTech, Digital Media, FinTech, Digital Health, Enterprise Software, AI, ML, Hardware, Infrastructure, Cloud Computing, PropTech, Health Care, BioTech)

Number of investments: 105

Number of exits: 13

Check size: $100k – $1m

Notable investments: MasterClass, Groq, Modern Treasury

Founders/Key People: Sarah Kunst, Genalin Setarios

Website: https://www.cleocap.com

Cloud Capital (India)

Cloud Capital is a venture capital firm based in Delhi, India. As a venture capital entity, Cloud Capital has a history of engaging in various funding rounds, predominantly supporting early-stage companies. They have a track record of investing in diverse technology-oriented companies, financial software, and other tech-related fields. Cloud Capital has made a significant impact in a relatively short time by investing in over 50 startups.

Headquarters: India

Investment Geography: India, Poland

Operating since: 2020

Stages: Pre-Seed, Seed, Pre-Series A

Investment Focus: Cloud Economy (FinTech, Digital Health, FoodTech, EdTech, Web 3, Gaming, Blockchain, RetailTech, Commerce Tech, Dev Tools, SaaS, Software, B2B)

Number of investments: 54

Number of exits: 6

Check size: $100k – $1m

Notable investments: ChangeJar Technologies, Tortoise

Founders/Key People: Randy Cloud, Anna Chen

Website: https://www.cloudcap.in

Comcast Ventures (CVC)

Comcast Ventures is the private venture capital affiliate of Comcast Corporation. Founded in 1999 and based in San Francisco, Comcast Ventures invests in innovative businesses that are shaping the future of entertainment, communications, and digital technology. The firm partners with entrepreneurs who demonstrate vision, passion, and tenacity.

Headquarters: USA

Investment Geography: Singapore, USA, Israel, Canada, UK, Germany, Finland, Singapore, Sweden, France, Ghana, UAE, China

Operating since: 1999

Stages: Seed, Series A, Series B, Series C, Series D

Investment Focus: Enterprise (Enterprise Software, Cloud Infrastructure, CyberSecurity, Data Analytics, Business Intelligence, FinTech, InsurTech, Blockchain, Marketplaces, Digital Media, MarTech, AdTech, Telecommunication, Wireless, Data, LegalTech, Future of Work, Mobile, HRTech, HealthTech, IoT, AI, EdTech, Robotics, Drones, TravelTech, Hardware), Consumer (Consumer Brands, SaaS, E-commerce, Automotive, RetailTech, Fashion, Personal Care, Mobility, PropTech, Hardware, Beauty, Gaming, Sports, eSports, VR, AR, Content, FoodTech, Social)

Number of investments: 482

Number of exits: 200

Check size: $2m – $100m

Notable investments: Datadog, Slack, Instacart

Founders/Key People: Ryan Lee, Allison Goldberg

Website: https://comcastventures.com

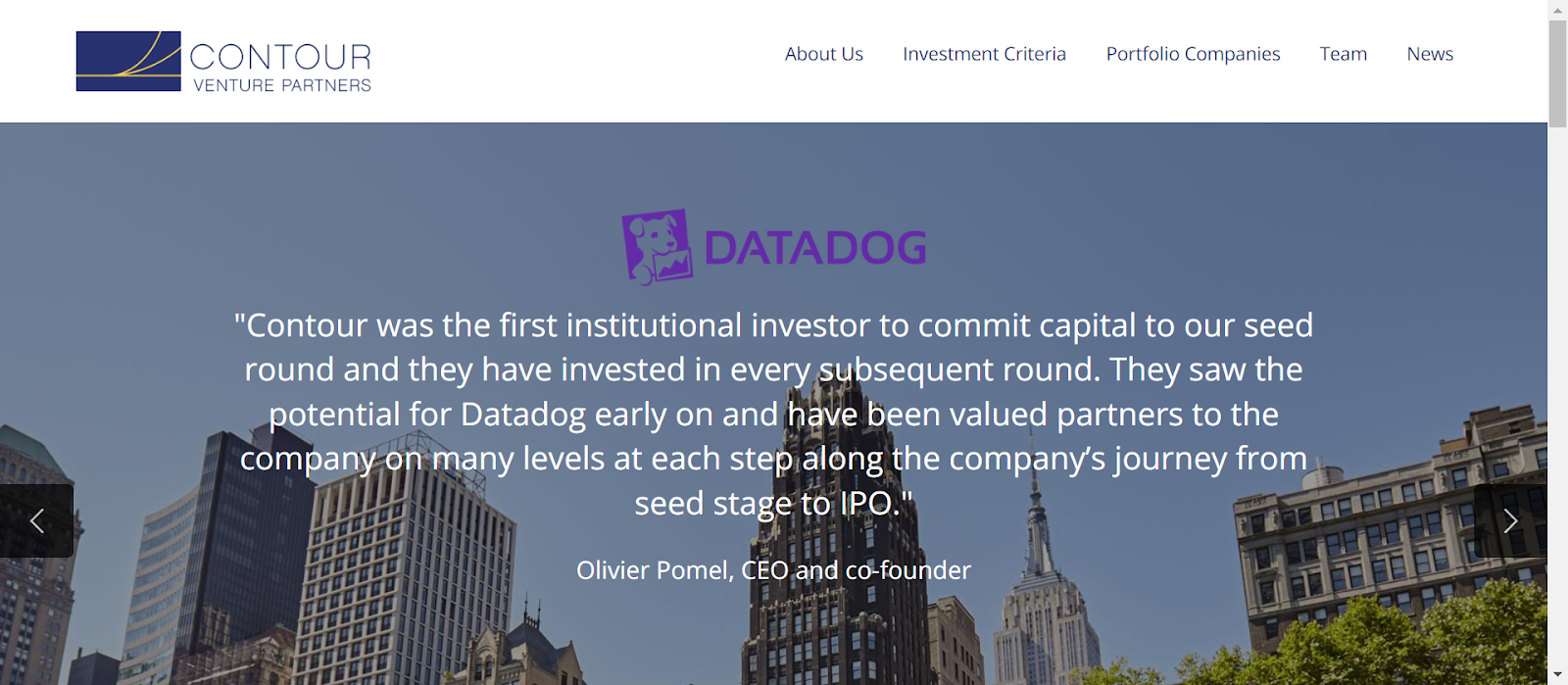

Contour Venture Partners

Contour Venture Partners, founded in 2005, is a New York City-based seed-stage venture capital firm. The firm specializes in seed-stage companies providing innovative software solutions in enterprise SaaS, vertical B2B SaaS, and financial services sectors, primarily in New York City. Contour Venture Partners is known for partnering with passionate entrepreneurs and management teams to build businesses that aim to transform their industries. As of 2023, Contour has managed 7 funds, supporting 200+ companies, and has been involved in 33 liquidity events.

Headquarters: USA

Investment Geography: UK, USA, Canada, Israel

Operating since: 2005

Stages: Seed,Series A

Investment Focus: FinTech,InsurTech,Enterprise Software,Cloud Infrastructure,Digital Media, Sports, Robotics,Data Analytics, AI, ML, IoT, MarTech, AdTech, EdTech, RetailTech, HealthTech, Digital Health, PropTech,Construction, FoodTech,EnergyTech,Marketplaces

Number of investments: 202

Number of exits: 43

Check size: $500k – $3m

Notable investments: Datadog, Pendo

Founders/Key People: Matt G., Bob Greene

Website: https://www.contourventures.com

Correlation Ventures

Correlation Ventures is a venture capital firm known for its efficient decision-making process and flexible investment approach. They offer a transparent and efficient process for startups, focusing on maintaining the founders’ focus on their business. The firm provides flexible check sizes ranging from $100,000 to $4 million. Correlation Ventures prides itself on its data-driven fundraising approach and strong relationships in the industry, helping startups find the right investors and partners quickly. The firm boasts one of the industry’s broadest portfolios, connecting companies to a network of potential customers, partners, and mentors.

Headquarters: USA

Investment Geography: USA, Germany, Switzerland, Canada, India, Nigeria

Operating since: 2006

Stages: Seed,Series A,Series B

Investment Focus: Consumer,Enterprise,FinTech,InsurTech,Payments,Wealth Management, Health Care, BioTech, Biopharma, Therapeutics, MedTech, EdTech, E-commerce, FoodTech, DTC, Fashion, Food & Beverages,Digital Media,Gaming, Mobility, AI, Data Analytics, Cloud Infrastructure, Software, Digital Health,HealthTech, VR, CyberSecurity, Dev Tools, MarTech, HRTech, Logistics,Real Estate,PropTech, RetailTech,Semiconductors, Energy

Number of investments: 503

Number of exits: 162

Check size: $100k – $4m

Notable investments: New Relic, Synthorx

Founders/Key People: David Coats, Trevor Kienzle

Website: https://correlationvc.com

Creandum

Creandum, founded in 2003, is a Stockholm-based venture capital advisory firm specializing in early-stage investments. The firm primarily focuses on technology and disruptive technology across various sectors, including consumer, telecommunication, materials, semiconductors, wireless access, digital media, enterprise, and hardware companies. Creandum has a broad geographic presence with locations in Stockholm, San Francisco, and Berlin.

Headquarters: Sweden

Investment Geography: Sweden, USA, Germany, UK, Austria, Norway, Finland, Denmark, France, Hungary, Estonia, Chile, Spain, South Korea, Czech Republic, Netherlands

Operating since: 2003

Stages: Seed, Series A, Series B

Investment Focus: Enterprise Software,Enterprise Infrastructure,Data Analytics, DevTools, FinTech, InsurTech,FoodTech,Mobility, Logistics,HRTech,HealthTech,Digital Health, Fitness, eSports, Gaming,TravelTech,RetailTech,E-commerce,EdTech,VR,Digital Media, Music, Blockchain, Crypto, IoT, Marketplaces,Semiconductors

Number of investments: 265

Number of exits: 65

Check size: $200k – $8m

Notable investments: Neo4j, Spotify

Founders/Key People: Beata Klein, Daniel Blomquist

Website: https://www.creandum.com

Cultivation Capital

Cultivation Capital is a venture capital firm that invests in young companies with transformative ideas. Their investment focus spans from Series Seed through Series B stages, assisting companies in managing rapid growth. The firm’s check size range is between $100,000 and $3.5 million. They invest across various industries and stages, including life sciences, health tech, software, IT, agriculture, and food tech.

Headquarters: USA

Investment Geography: Sweden, USA, Denmark, Senegal, Ireland, Australia, Argentina, Canada, Israel, Switzerland, Poland

Operating since: 2012

Stages: Seed,Series A,Series B

Investment Focus: Life Sciences & HealthTech (Therapeutics,Diagnostics,Research Tools & Reagents, Medical Devices, Health Care IT), AgTech & FoodTech (Crops,Animal Health,Precision Agriculture, Sustainability, Logistics,Food Ingredients), FinTech,Software & IT (FinTech, PropTech, Real Estate, MarTech, CyberSecurity, E-commerce, RetailTech,Hospitality,AR,AI,Data Analytics, HRTech, DevTools, Transportation, Marketplaces)

Number of investments: 240

Number of exits: 47

Check size: $100k – $3.5m

Notable investments: Gainsight, Redox Engine

Founders/Key People: Brian Matthews, Andy Dearing

Website: https://cultivationcapital.com

CyberAgent Capital

CyberAgent Capital operates several funds, each focusing on different geographical regions and investment stages. They have multiple funds for investments in Japan, China, and Southeast Asia. The fund sizes vary, with examples including ¥6,000,000,000 for the CA Startups Internet Fund 3, L.P. in Japan and US$19.0 million for the CA-JAIC China Internet Fund Ⅱ, L.P.

Headquarters: Japan

Investment Geography: Japan, USA, Vietnam, Indonesia, China, Thailand, South Korea, Singapore, Taiwan, Hong Kong, Malaysia, Canada, Australia

Operating since: 2006

Stages: Seed,Series A

Investment Focus: Internet (Enterprise Software,MarTech,FinTech,Digital Media, EdTech, Gaming, FoodTech,JobTech,TravelTech,Digital Health, HealthTech, Social, PropTech, E-commerce, Marketplaces, IoT,Blockchain,Logistics,Mobility)

Number of investments: 396

Number of exits: 144

Check size: $100k – $5m

Notable investments: VNG, Tokopedia

Founders/Key People: Nguyen Tuan, Takashi Kitao

Website: https://www.cyberagentcapital.com/en/

Data Point Capital

Data Point Capital is a venture capital firm primarily focused on the Internet sector. Based in Boston, Massachusetts, the firm comprises business executives and internet leaders with substantial experience in creating value by developing successful companies. They operate with a philosophy of being entrepreneurs who assist other entrepreneurs. Data Point Capital has been involved in building numerous successful ventures, leveraging their expertise to foster growth and innovation in internet-focused startups.

Headquarters: USA

Investment Geography: USA, India, Greece

Operating since: 2012

Stages: Seed,Series A

Investment Focus: Consumer Internet (E-commerce,Mobile,Media),Enterprise Software,Cyber Security,AdTech,MarTech,JobTech,HRTech,eSports,FoodTech,IIoT,Marketplaces

Number of investments: 51

Number of exits: 13

Check size: $100k – $3m

Notable investments: FlexCar, JobGet

Founders/Key People: Geoff Oblak, Scott Savitz,

Website: https://datapointcapital.com

DO Venture Partners

DO Venture Partners invests in early stage startups focusing on blockchain, sustainability and AI. Invests in startups in the Bay Area by partnering with European VC Funds. The VC firm has 18 investments and typically invests in the USA, China and Australia. It has made a total investment amounting to about $4m since 2016.

Headquarters: USA

Investment Geography: USA, Australia, China

Operating since: 2016

Stages: Seed,Series A,Series B

Investment Focus: Future of Work,FinTech,Enterprise Collaboration,Enterprise Software,Dev Tools,LegalTech,E-commerce,SaaS,Consumer Goods,Consumer Services,FoodTech

Number of investments: 18

Number of exits: 5

Check size: $50k – $200k

Notable investments: Odeko, Kapwing

Founders/Key People: Duygu Clark, Steven Olson

Website: https://doventurepartners.com

Drive Capital

Drive Capital, founded in 2013 by Mark Kvamme and Chris Olsen, is a venture capital firm based in Columbus, Ohio, focusing on tech startups outside Silicon Valley. The firm’s investment portfolio includes various companies across the United States and Canada, with notable examples like Duolingo and Olive. Drive Capital has established several funds, including a $250 million venture capital fund in 2014, a $300 million fund in 2016, and a $301 million expansion stage fund in 2020, bringing its total assets under management to $1.2 billion. Drive Capital has also announced an $80 million seed program, including plans to invest $500,000 in up to 160 founders, particularly focusing on pre-seed and seed companies located in selected North American cities.

Headquarters: USA

Investment Geography: USA, Canada

Operating since: 2012

Stages: Series A,Series B

Investment Focus: Enterprise Software,Infrastructure,AI,ML,Data Science, InsurTech, EdTech, HealthTech, Robotics,TravelTech,IoT,Marketplaces,FoodTech,E-commerce

Number of investments: 135

Number of exits: 26

Check size: $250k – $75m

Notable investments: Duolingo, Sidecar Health, Olive

Founders/Key People: Avoilan Bingham, Chris Olsen

Website: https://www.drivecapital.com

Endiya Partners

Endiya Partners, established to catalyze the third wave of Indian entrepreneurship, specializes in early-stage investments in scalable product companies. This venture capital firm focuses on sectors like digital industry and mobility, digital health, and life sciences. They actively support startups by being the first institutional investors, taking on high risks, and working closely with founders. Endiya Partners is known for its hands-on “operator VC” approach, leveraging its team’s experience as entrepreneurs and operators to provide strategic guidance and operational support to portfolio companies.

Headquarters: India

Investment Geography: India, USA, Israel, Singapore

Operating since: 2015

Stages: Seed,Pre-Series A

Investment Focus: Digital Transformation,HealthTech,Digital Health, Diagnostics, Wellness, AI, ML, IoT,Electric Mobility,CleanTech,Semiconductors,Enterprise Software,FinTech,CyberSecurity, FoodTech

Number of investments: 58

Number of exits: 6

Check size: $500k – $5m

Notable investments: Cure.fit, Darwinbox

Founders/Key People: Ramesh Byrapaneni, Sateesh Andra

Website: https://endiya.com

Eniac Ventures

Eniac Ventures, founded by four college friends, is a venture capital firm specializing in leading seed rounds for bold founders. With over 80 years of combined experience in building companies, the firm actively supports its portfolio companies beyond just providing capital. Eniac Ventures focuses on founders creating transformational companies, offering them full access to its general partners and the Eniac Platform. The firm’s approach is about financial returns and nurturing the next generation of innovative entrepreneurs.

Headquarters: USA

Investment Geography: UK, USA, Israel, Canada, France, Spain, Germany, China, Greece, Switzerland, Singapore

Operating since: 2009

Stages: Pre-Seed,Seed

Investment Focus: Enterprise Software,FinTech,HealthTech,Digital Media, MarTech, EdTech, Gaming, FoodTech, Transportation, CyberSecurity, PropTech, Robotics, E-commerce, AR, VR, Marketplaces

Number of investments: 342

Number of exits: 102

Check size: $50k – $1.5m

Notable investments: Salesforce, Airbnb, Automattic

Founders/Key People: Timothy Young, Hadley Harris, Vic Singh

Website: https://eniac.vc

Entrée Capital

Entrée Capital is a venture capital firm that has partnered with exceptional founders to build the impossible for over a decade, from pre-seed to Series C stages. They focus on various sectors, including Fintech, Deeptech, AI, Blockchain, SaaS, and the reinvention of old industries. Entrée Capital supports startups from the idea stage to when it’s time to scale, reserving funds for different stages of growth. They align closely with founders, providing market insights and connecting them with relevant global players and partners. The firm’s portfolio includes companies like Monday.com, Cazoo, Coupang, Stash, Rapyd, Stripe, and SeatGeek.

Headquarters: UK

Investment Geography: UK, USA, Israel, Germany, Netherlands, Australia, Nigeria, France, Norway, UAE, South Korea, Spain, South Africa, Canada, Brazil

Operating since: 2009

Stages: Seed,Series A,Series B

Investment Focus: Enterprise Software,Software Infrastructure,FinTech,Deep Tech,Quantum Computing, VR,AR,AI,Big Data,Data Analytics,Blockchain,FoodTech,CyberSecurity, Retail, E-commerce, EdTech,Digital Health,Digital Media,MarTech,AdTech,LegalTech,Real Estate, Construction, Logistics,Marketplaces

Number of investments: 306

Number of exits: 70

Check size: $250k – $15m

Notable investments: Monday.com, Rapyd, Cazoo, Stripe

Founders/Key People: Avi Eyal, Eran Bielski

Website: https://entreecap.com

Enygma Ventures

Enygma Ventures is a unique, purpose-driven investment fund led by experienced entrepreneurs focusing on growing and scaling businesses in Africa, the US, and Europe. The firm primarily invests in women entrepreneurs in Sub-Saharan Africa, addressing the unique challenges and gender gap in entrepreneurship. They offer support from the ideation stage to early-stage funding, providing flexible financial solutions, strategic capital deployment, and tailored support. Enygma Ventures’ investments range between $200,000 to $500,000. They prioritize scalable businesses with a unique proposition led by dynamic entrepreneurs with proven revenue models and clear purposes.

Headquarters: South Africa

Investment Geography: South Africa, USA, Zambia, Swaziland, Kenya

Operating since: 2019

Stages: Seed,Series A

Investment Focus: Female Founders (Enterprise Software, FinTech, EdTech, FoodTech, CleanTech, PropTech, Consumer Brands,Health,D2C,Digital Media)

Number of investments: 23

Number of exits: 3

Check size: $200k – $500k

Notable investments: Koa Academy, Lupiya

Founders/Key People: Jacob Dusek, Andrew Whiley

Website: https://www.enygmaventures.com

EQT Ventures

EQT Ventures, a venture capital firm based in Stockholm, Sweden, is part of the larger EQT AB Group. Founded in 2015, the firm focuses on seed-stage, early-stage, and later-stage investments, primarily in the IT and SaaS sectors. EQT Ventures operates across Europe and the United States and has raised over €2.3 billion in total capital. Its first fund, EQT Ventures I, was launched in May 2016 with commitments totaling €566 million. The firm has been involved in multiple investments across various sectors and has established a significant presence in the VC landscape. EQT Ventures makes equity investments ranging from €100k to €75 million in startups and scale-ups across Europe and the U.S.

Headquarters: Sweden

Investment Geography: Sweden, UK, USA, Germany, Netherlands, France, Norway, Canada, Finland, Switzerland, Ireland, Portugal, Denmark, Cyprus, Estonia

Operating since: 2015

Stages: Seed,Series A,Series B,Series C

Investment Focus: Enterprise Software, MarTech, Sports, Transportation, Automotive, Autonomous Electric Vehicles, Aerospace, Fitness, Wearables, RetailTech, Delivery, FinTech, InsurTech, Gaming,Mobile,Mobility,Robotics,Digital Media, AdTech, HRTech, DevTools, HealthTech, Digital Health,Construction, CyberSecurity, Marketplaces, Hardware, PropTech, Manufacturing, FoodTech,Supply Chain,TravelTech,Data Analytics,AI,AR,VR

Number of investments: 190

Number of exits: 25

Check size: €100k to €75m

Notable investments: Einride, Wolt

Founders/Key People: Tomas Pivarci,

Website: https://eqtventures.com

Felix Capital

Felix Capital, founded in 2014 and based in London, UK, is a venture capital firm specializing in early-stage investments. They primarily focus on digital lifestyle, investing in emerging digital consumer brands, and related enabling technologies. The firm invests across Europe and selectively in North America. Their investment areas include food, shopping, health, wellness, personal finance, entertainment, communication, gaming, and professional life transformation tools. Felix Capital recently raised a $600 million fund, doubling its total committed capital to over $1.2 billion. They plan to back another 20-25 companies over the next few years, focusing significantly on Web3 and sustainable living.

Headquarters: UK

Investment Geography: UK, USA, Canada, Germany, France, Sweden, Netherlands, Spain, Luxembourg, Austria, New Zealand, Turkey

Operating since: 2014

Stages: Seed,Series A,Series B

Investment Focus: Consumer Brands,Consumer Services,Consumer Tech (D2C,FinTech,Digital Brands, Fashion,Apparel,Beauty,Jewellery,E-commerce,Digital Media,FoodTech,Plant-based Food,Mobility, Transportation,Enterprise Software (Retail,MarTech,E-commerce),Real Estate, PropTech, JobTech,Fitness,Wellness,Digital Health,HealthTech,TravelTech,Consumer Marketplaces)

Number of investments: 127

Number of exits: 16

Check size: $1m – $50m

Notable investments: Spotify, Deliveroo, Moonbug

Founders/Key People: Frederic Court, Antoine Nussenbaum

Website: https://www.felixcap.com

ff Venture Capital

ff Venture Capital, established in 2008, is a notable venture capital firm based in New York City. Founded by John Frankel and Alex Katz, the firm specializes in providing seed-stage and early-stage funding to technology companies. ff Venture Capital is known for its strong focus on emerging industries such as AI, Enterprise Software, FinTech, Automation, and Sustainability. The firm prides itself on being one of the best-performing seed and early-stage venture capital firms in New York, actively partnering with founders to create high-value, market-moving businesses. They have a notable track record of investing in companies that have the potential to impact their respective markets significantly.

Headquarters: USA

Investment Geography: UK, USA, Canada, Germany, France, Netherlands, Poland, Israel, Estonia, Mexico, Ireland, Ukraine, India

Operating since: 2008

Stages: Seed,Series A,Series B

Investment Focus: Enterprise Software,CyberSecurity,AI,ML,Data Analytics, FinTech, Robotics, Drones, AdTech,MarTech,Consumer,EdTech,Hardware,HealthTech,FoodTech,Marketplaces

Number of investments: 336

Number of exits: 81

Check size: $300k – $700k

Notable investments: Addepar, Surf Air, Movable Ink

Founders/Key People: Mariusz Adamski, Florin Mihoc

Website: https://ffvc.com

Fifty Years

Fifty Years is a venture capital firm focusing on pre-seed and seed investments. Founded with the mission of using technology to solve the world’s biggest problems, the firm is particularly interested in backing founders who are tackling issues like the climate crisis, disease, and malnutrition. Fifty Years also emphasizes helping world-class scientists transition into successful entrepreneurs, having backed a significant number of Ph.D. founders and CEOs. Founders of billion-dollar tech companies support the firm and it has a history of backing projects with substantial scientific research and citations.

Headquarters: USA

Investment Geography: UK, USA, Canada, Germany, Netherlands, Australia, Senegal, Nigeria

Operating since: 2016

Stages: Seed,Series A

Investment Focus: Synthetic Biology, FoodTech, Education, Health, Civic, Community, Energy, Hardware, Software,Robotics

Number of investments: 134

Number of exits: 12

Check size: $100k – $3m

Notable investments: Substack, Astranis

Founders/Key People: Seth Bannon, Ela Madej

Website: https://fiftyyears.com

Firebrand Ventures

Firebrand Ventures is a venture capital firm that primarily invests in seed-stage companies located in underserved and emerging startup communities. The firm is committed to partnering with entrepreneurs to build transformative companies. Firebrand Ventures believes in nurturing trusted relationships with exceptional founders and supporting the development of revolutionary products. They operate with a philosophy of meeting founders where they are, indicating a flexible and founder-centric investment approach.

Headquarters: USA

Investment Geography: USA, Canada

Operating since: 2016

Stages: Seed,Series A

Investment Focus: Enterprise Software,Cloud Computing,VR,AI,Big Data,Business Intelligence, FinTech, EdTech,LegalTech,MarTech,Cyber Security,FoodTech,Consumer Internet, Fashion, Marketplaces, Autonomous Driving

Number of investments: 58

Number of exits: 9

Check size: $500k – $1m

Notable investments: Automox, Dwolla

Founders/Key People: John Fein, Chris Marks

Website: https://www.firebrandvc.com

Force Over Mass Capital

Force Over Mass Capital is a London-based venture capital firm specializing in early-stage technology investments. It aims to bridge the gap between venture capital and crowdfunding by offering a unique, transparent, technological investment solution. Force Over Mass is known for its focus on supporting exceptional founders, particularly those with contrarian ideas, by leveraging technology and financial innovation. This approach allows them to cater to diverse clients, including pension funds. Additionally, the firm seeks to deliver superior returns to its investors, facilitated by its innovative fund structure offering greater returns and shorter lock-up periods. Force Over Mass Capital typically engages in investment deals ranging from $1 million to $5 million.

Headquarters: UK

Investment Geography: UK, USA, Ireland, Germany, Belgium, Netherlands, Israel, Bulgaria, Austria, Spain, Brazil

Operating since: 2013

Stages: Seed,Series A,Series B

Investment Focus: AI & Robotics,Big Data & Analytics,Blockchain & Crypto,Cloud Computing & Networking, E-commerce,EdTech,FinTech & InsurTech,Gaming,Health & Bio,Industry 4.0, LegalTech & GovTech, Logistics & Mobility,MedTech,Marketplaces,Retail & Consumer, SaaS, Security, Social

Number of investments: 176

Number of exits: 37

Check size: $1m – $5m

Notable investments: Bud, Pelago,

Founders/Key People: Benjamin Tan, Nicholas Tyler

Website: https://fomcap.com

Fortino Capital Partners

Fortino Capital Partners, established in 2013, is a venture capital firm headquartered in Antwerp, Belgium, with an additional location in Amsterdam. Founded by Duco Sickinghe, the firm primarily focuses on investments in software-as-a-service (SaaS) products. Fortino Capital adopts a hybrid approach, combining venture capital and equity growth strategies to invest in both early-stage and more mature companies. The firm is particularly interested in businesses demonstrating a clear product-market fit, international scalability, and accelerating user adoption.

Headquarters: Belgium

Investment Geography: Belgium, USA, Netherlands, France, Germany, Portugal, Malta, Luxembourg, Bulgaria, Guatemala, Norway

Operating since: 2013

Stages: Series A,Series B

Investment Focus: E-commerce,Enterprise Software,SaaS,Cloud, FoodTech, Digital Conversion & IT Services, AI,Data Analytics,CyberSecurity,HealthTech,Consumer Brands, Transportation, Construction Tech, Marketplaces

Number of investments: 83

Number of exits: 22

Check size: €1m to €30m

Notable investments: Nowo, Oqton

Founders/Key People: Toon Smets, Renaat Berckmoes

Website: https://www.fortinocapital.com

Fosun RZ Capital

Fosun RZ Capital, founded in 2013, is a significant venture capital investment fund affiliated with the Fosun Group. The firm is headquartered in Beijing, China, and is led by Chairman Wilson Jin Hualong. It specializes in investing across various stages of a company’s lifecycle, from early startup phases to initial public offerings (IPOs). The firm’s assets under management total approximately $1.2 billion, and it has made significant investments in countries like India, Israel, and Southeast Asia, in addition to China and the United States. Fosun RZ Capital manages over 10 billion RMB and has led investments in more than 100 high-quality companies.

Headquarters: China

Investment Geography: China, USA, Canada, India, Israel, Belgium, Indonesia

Operating since: 2013

Stages: Seed,Series A,Series B,Series C

Investment Focus: Enterprise Software,Cloud Infrastructure,AI,Big Data,Data Analytics, IoT, Hardware, Automotive,Consumer Retail,FinTech,EdTech,E-commerce,Supply Chain, Logistics, HealthTech, FoodTech,Digital Media, Mobility, MarTech, TravelTech, HRTech, Semiconductors, Marketplaces

Number of investments: 143

Number of exits: 16

Check size: $500k – $75m

Notable investments: Deeproute.ai, Feidee, Vision X

Founders/Key People: Nir Halachmi, Zach Sun

Website: https://www.frzcapital.com

Framework Venture Partners

Framework Ventures is a venture capital firm that specializes in blockchain technology. It’s a thesis-driven firm that actively collaborates with founders to build token-based networks and develop the necessary crypto-economics, governance, and community structures to scale. Their investment focuses on reshaping consumer and enterprise web business models through permissionless innovation enabled by blockchain technology. Framework Ventures is known for partnering with teams to facilitate the global transition to decentralized technology.

Headquarters: Canada

Investment Geography: Canada, China, USA, UK, India, Australia, Singapore, Germany, Brazil, Vietnam, Ukraine, France, Denmark, Greece, Nicaragua, Hong Kong, British Virgin Islands, Finland

Operating since: 2018

Stages: Series A,Series B,Series C

Investment Focus: Enterprise (FinTech,InsurTech,AI,ML,Big Data,Business Intelligence, SaaS, Cloud, Mobile,Retail,E-commerce,FoodTech,Data-Driven Services)

Number of investments: 29

Number of exits: 3

Check size: $3m – $10m

Notable investments: Andalusia Labs, Incode Technologies

Founders/Key People: Michael Anderson, Vance Spencer

Website: https://www.framework.vc

FreshTracks Capital

FreshTracks Capital is a venture capital firm established in 2000, headquartered in Shelburne, Vermont. The firm specializes in seed and early-stage investments, focusing on various sectors, including advanced manufacturing, B2B software, consumer products, digital media, energy, food and beverage, medical technology, and technology. FreshTracks Capital’s investment strategy centers on businesses with the potential to create defensible competitive advantages and prioritizes companies led by proven high-performing management teams. The average investment per company by FreshTracks Capital is around $600,000.

Headquarters: USA

Investment Geography: USA, France

Operating since: 2000

Stages: Seed,Series A,Series B, Series C

Investment Focus: Enterprise Software,Cloud Infrastructure,AI,ML,Data Analytics, FinTech, InsurTech, Cyber Security,AutoTech,FoodTech,AgTech,Beverages,Consumer Products, Solar, Consumer Brands, HRTech,SpaceTech,EnergyTech,Digital Media,HealthTech, Digital Health, VR, PropTech, Mobility, Clean Energy,Renewable Energy, Social, TravelTech, Manufacturing, E-commerce, Green Tech

Number of investments: 97

Number of exits: 36

Check size: $400k – $5m

Notable investments: Quirky, Mophie

Founders/Key People: Cairn Cross, Lee Bouyea

Website: https://www.freshtrackscap.com

FTW Ventures

FTW Ventures is a venture capital firm specializing in early-stage investments, particularly in the food and agriculture technology sectors. They invest in companies with the potential to impact the world significantly, aiming to modernize the food system through disruptive sciences and technology. FTW Ventures engages in a wide range of activities from backing biotechnology to improving supply chain sensors, automation for farmers, and software for demand prediction at retail. As for their check size, FTW Ventures typically invests between $100,000 and $500,000 in early-stage and pre-seed food tech startups.

Headquarters: USA

Investment Geography: USA, Belgium, UK

Operating since:

Stages: Seed,Series A

Investment Focus: FoodTech,AgTech (Hardware,Software,Biotech)

Number of investments: 15

Number of exits: 0

Check size: $100k – $500k

Notable investments: Geltor

Founders/Key People: Brian Frank, Jenn Burka

Website: https://www.ftw.vc

FUSE

FUSE Venture Partners is a venture capital firm founded in 2020 in Seattle. It primarily focuses on supporting SaaS (Software as a Service) entrepreneurs, offering more than just financial investment. The firm emphasizes building a robust network, sharing knowledge, and integrating entrepreneurs into their portfolio community, aiming to amplify their success and growth. FUSE operates with a hands-on approach to help startups achieve more in their respective fields.

Headquarters: USA

Investment Geography: USA, Canada

Operating since: 2020

Stages: Pre-Seed,Seed,Series A

Investment Focus: Software,B2B,Enterprise,SaaS (FinTech,Digital Health, MarTech, TravelTech, FoodTech, Event Tech,Real Estate,Media)

Number of investments: 43

Number of exits: 0

Check size: $500k – $10m

Notable investments: Zuper, Carbon Robotics

Founders/Key People: Cameron Borumand, Kellan Carter

Website: https://fuse.vc

Globis Capital Partners

Globis Capital Partners, established in 1996 by Yoshito Hori, is a Japanese venture capital firm based in Tokyo. As a significant player in the venture capital space, Globis has a focused approach toward investing in companies, predominantly taking on the role of a lead investor. Its success is reflected in its involvement with numerous IPOs, with 36 of its investments reaching IPO status. Moreover, Globis Capital Partners manages a substantial fund size, with its assets under management (AUM) exceeding $1 billion.

Headquarters: Japan

Investment Geography: Japan, USA, Singapore, Malaysia, United Kingdom, Israel

Operating since: 1996

Stages: Seed,Series A,Series B

Investment Focus: Consumer Marketplaces, HealthTech, E-commerce, FinTech, InsurTech, IoT, EdTech, Games,Digital Media,Social,Mobile,PropTech,FoodTech,Enterprise Software,AI,Data Analytics,Mobility,Cloud Infrastructure, ConstructionTech, Logistics, HRTech, MarTech, Drones, SalesTech, Robotics, Semiconductors,Hardware, Advanced Manufacturing

Number of investments: 193

Number of exits: 62

Check size: $1m – $50m

Notable investments: Mercari, Telexistence,

Founders/Key People: Emre Yuasa, Kosuke Fukagawa

Website: https://www.globiscapital.co.jp/en/

Golden Ventures

Golden Ventures is a venture capital firm based in Toronto, Canada, established in 2011 by Matt Golden. It specializes in funding seed-stage companies across North America. The firm’s investment focus includes a wide range of sectors such as manufacturing, business services, consumer products and services, education, energy, eSports and gaming, fintech, food, logistics, media, and e-commerce. Golden Ventures is known for its early-stage investments, predominantly in seed-stage companies, but also provides follow-on investment up to Series A and occasionally beyond. Golden Ventures typically issues initial checks between $500K and $2M.

Headquarters: Canada

Investment Geography: Canada, Singapore, USA, France

Operating since: 2011

Stages: Seed,Series A,Series B

Investment Focus: AdTech, Aerospace, Biotechnology, E-commerce, EdTech, FinTech, FoodTech, Hospitality, HealthTech, Life Sciences, Analytics, Digital Media, Entertainment, Marketplaces, Hardware, MarTech, Material Science, Robotics, Enterprise Software

Number of investments: 183

Number of exits: 34

Check size: $500K and $2M

Notable investments: Zynga, Salesforce

Founders/Key People: Matt Golden, Bert Amato

Website: https://www.golden.ventures

Gravity Ventures

Gravity Ventures, established in 2008, is a venture capital firm based in Indiana and Arkansas. It primarily focuses on early-stage technology and tech-enabled businesses across various industries. The firm operates as a member-managed angel, pre-seed, and seed capital fund. Initially starting with a single seed capital fund, Gravity Ventures has expanded to oversee six seed capital funds. The firm stands out for its supportive approach towards entrepreneurs and ventures, prioritizing personable and experienced investment teams over formal corporate atmospheres.

Headquarters: USA

Investment Geography: Israel, USA

Operating since: 2008

Stages: Seed,Series A

Investment Focus: Tech & Tech-enabled (Enterprise Software, AI, Data Analytics, Business Intelligence, RetailTech, SalesTech, E-commerce, MarTech, Content, Digital Media, BioTech, HealthTech, Digital Health, MedTech, Consumer Internet, Mobile, FoodTech, FinTech, InsurTech, EdTech, Gaming, Marketplaces)

Number of investments: 54

Number of exits: 29

Check size: $250k – $3m

Notable investments: DivvyHQ, Bluebridge

Founders/Key People: Debra Cirone, Sumi Maun

Website: https://gravityventures.com

GreatPoint Ventures

GreatPoint Ventures is an early-stage venture capital firm founded by a team of entrepreneurs and operators who have collectively built companies with an enterprise value of over $300 billion. Established in 2015 and based in San Francisco, California, the firm primarily focuses on investments in sectors like biotech, healthcare, technology, consumer products, enterprise, digital health, proptech, logistics, fintech, climate, and food & agriculture. GreatPoint Ventures is selective in its investments, making fewer than ten new investments each year. They engage in various funding rounds, including pre-seed, seed, Series A, and Series B+. The firm’s check size ranges from $100K to $3M.

Headquarters: USA

Investment Geography: UK, USA, Canada, Poland, Finland, Singapore

Operating since: 2015

Stages: Series A,Series B

Investment Focus: AI, ML, Data Analytics, Robotics, VR, BioTech, Health Care, Therapeutics, Medical Devices, MedTech, HealthTech, FoodTech, Enterprise Software, Cloud Infrastructure, FinTech, Retail, E-commerce, Cyber Security, EdTech, Manufacturing, Semiconductors

Number of investments: 130

Number of exits: 16

Check size: $100K to $3M

Notable investments: Extend, Beyond Meat

Founders/Key People: Andrew Perlman, Ray Lane

Website: https://www.gpv.com

Greenoaks Capital

Greenoaks Capital, founded in 2010 by Neil Mehta in San Francisco, California, is a venture capital and private equity firm. It primarily invests in technology companies, focusing on long-term investments. As of January 2024, Greenoaks Capital had at least 28 companies in its portfolio. Some notable investments include Robinhood, Airtable, Stripe, Discord, Flipkart, Canva and Deliveroo. They are known for investing in seed-stage, early-stage, and later-stage companies across various sectors like fintech, health tech, and technology sectors.

Headquarters: USA

Investment Geography: UK, USA, Canada, Brazil, France, India, Mexico, Germany, South Korea, Australia, Hong Kong, Sweden, Singapore, Israel, Italy, Chile, Japan

Operating since: 2012

Stages: Series A, Series B, Series C, Series D

Investment Focus: AI, ML, Enterprise Software, InsurTech, CyberSecurity, FoodTech, Hospitality, TravelTech, Retail, HealthTech, Digital Health, PropTech, FinTech, JobTech, Manufacturing, Marketplaces

Number of investments: 117

Number of exits: 33

Check size: $1m – $100m

Notable investments: Canva, Flipkart, Airtable

Founders/Key People: Neil Mehta, Anant Majumdar

Website: https://greenoaks.com

Haatch Ventures

Haatch Ventures, founded in September 2013 and incorporated as Haatch Ventures LLP in 2018, specializes in early-stage investments in technology companies with a focus on SaaS, retail, and mobile verticals. The firm became fully authorized in 2020 and operates under the Haatch Angel brand and EIS fund, seeking scalable and disruptive growth models. They offer significant cash investments and expert support to maximize success chances. Haatch Ventures takes advantage of SEIS & EIS schemes for tax reliefs, emphasizing investments that can potentially return 10x or more.

Headquarters: UK

Investment Geography: UK, USA, Ireland, Australia, Japan

Operating since: 2013

Stages: Pre-Seed,Seed,Post-Seed,Series A

Investment Focus: Consumer Tech, Consumer SaaS, Consumer Services, FoodTech, Social Media, TravelTech, Enterprise Software, AR, MR, AI, Blockchain, Infrastructure, Smart Devices, Digital Media, Video, Marketplaces

Number of investments: 102

Number of exits: 11

Check size: $25k – $500k

Notable investments: Marvel, Buymie

Founders/Key People: Scott Weavers-Wright, Fred Soneya

Website: https://haatch.com

Hanaco Ventures

Hanaco Venture Capital, based in New York and Tel Aviv, focuses on investing in seed to later-stage companies within the consumer products, services, and IT sectors in the U.S. and Israel. They aim to partner with Israeli companies globally, assisting them in becoming category leaders. Their investment rounds range from seed funding to growth stages, indicating a flexible approach to funding, and supporting companies at various development stages.

Headquarters: Israel

Investment Geography: UK, USA, Israel, Germany

Operating since: 2017

Stages: Seed,Series A,Series B,Series C

Investment Focus: Israeli Founders (Enterprise Software, AI, ML, Data Science, Blockchain, Cloud, Cyber Security, Rogue Device Mitigation, FinTech, MarTech, AgTech, FoodTech, Digital Health, HealthTech, Mobility, E-commerce, Supply Chain, Real Estate Tech)

Number of investments: 89

Number of exits: 12

Check size: $2m – $20m

Notable investments: Divvy, Infarm, Yotpo

Founders/Key People: Pasha Romanovski, Lior Prosor

Website: https://www.hanacovc.com

Haystack

Haystack, founded by Semil Shah in 2013, is an early-stage venture capital firm focused on supporting outlier founders. Shah started Haystack after recognizing his passion for investing and, despite initial challenges, was encouraged by venture capitalists and founders he knew to start his fund. Like a startup, the firm emphasizes staying nimble without a fixed office or defined process, instead focusing on identifying founders with unique insights to support.

Headquarters: USA

Investment Geography: USA, Israel, Canada, Puerto Rico, Mexico, South Africa, Australia

Operating since: 2013

Stages: Seed,Series A

Investment Focus: FinTech, Consumer Internet, E-commerce, FoodTech, B2B, Software/SaaS, Tech

Number of investments: 133

Number of exits: 10

Check size: $100k – $1m

Notable investments: Figma, Doordash, Instacart

Founders/Key People: Semil Shah, Divya Dhulipala

Website: https://haystack.vc/

Human Ventures

Human Ventures, founded in 2015 and based in New York, is a venture capital firm that adopts a human-first approach to investing. It focuses on early-stage companies, partnering with founders from the outset and supporting them through growth stages. The firm invests in various sectors, addressing essential human needs such as health and wellness, workplace innovation, community connection, and media. Human Ventures stands out for its commitment to building companies that meet these broad, fundamental needs.

Headquarters: USA

Investment Geography: USA, Denmark

Operating since: 2015

Stages: Seed,Series A

Investment Focus: Enterprise Software, EdTech, Digital Media, Digital Health, HealthTech, Wellness, FoodTech, FinTech, E-commerce, LegalTech, AR, Marketplaces

Number of investments: 121

Number of exits: 18

Check size: $250k – $500k

Notable investments: Current, Tia

Founders/Key People: Heather Hartnett, Michael Letta

Website: https://human.vc

HV Capital

HV Capital is a venture capital firm established in 2000, with a focus on supporting exceptional founders in building market-leading digital companies across Europe. It has a strong heritage, originating from Holtzbrinck, one of Europe’s largest publishing groups, which aligns with its mission to back daring visions from seed stage to exit. HV Capital has made significant strides in the venture capital landscape by investing in over 400 disruptors across various industries, leading to the creation of over 100,000 jobs.

Headquarters: Germany (Munich, Germany)

Investment Geography: Europe, especially in German markets

Operating since: 2000

Stages: Seed, Series A, Series B

Investment Focus: Enterprise Software, Cyber Security, E-commerce, RetailTech, LegalTech, EdTech, Music, JobTech, HRTech, Logistics, FinTech, InsurTech, FoodTech, AI, ML, AR, VR, Marketplaces, Digital Health, Fitness, HealthTech, Real Estate, PropTech, Digital Media, Sports, TravelTech, Dating, Social, Gaming, Fashion, AdTech, MarTech, Blockchain, Crypto, IoT

Number of investments: 458

Number of exits: 168

Check size: $690k – $69m

Notable investments: SumUp, JOKR, Sennder

Founders/Key People: Lars Langusch, Christian Saller

Website: https://www.hvcapital.com/

Icehouse Ventures

Icehouse Ventures is a venture capital firm based in Auckland, New Zealand, focusing primarily on the technology industry. It was formally founded as part of the Icehouse group, a broader initiative to encourage innovation and entrepreneurship in New Zealand. The firm’s roots can be traced back to the formation of Ice Angels, New Zealand’s first angel network, in 2003, which grew into the country’s most active angel network over the next decade. By 2013, Icehouse Ventures had raised its first fund and, as of now, has scaled into an early-stage venture firm with $380 million invested. It operates a suite of funds with different portfolio strategies, supporting New Zealand founders to build world-class companies.

Headquarters: New Zealand (Auckland, New Zealand)

Investment Geography: New Zealand

Operating since: 2006

Stages: Seed, Series A, Series B

Investment Focus: Enterprise Software, AI, ML, Big Data, Data Analytics, FinTech, InsurTech, EdTech, Space, Aerospace, Wireless, Maritime, BioTech, Medical Devices, Advanced Materials, Sustainability, Drones, Digital Media, E-commerce, Consumer Products, FoodTech, AgTech, CleanTech, Wearables, Beverages, MarTech, SalesTech, TravelTech, CRE, PropTech, Hardware, Marketplaces

Number of investments: 192

Number of exits: 12

Check size: $100k – $5m

Notable investments: Easy Crypto, First AML, Tradify, Avertana

Founders/Key People: Robbie Paul, Matt Gunn, Anne Catley

Website: http://www.icehouseventures.co.nz/

ID Ventures

ID Ventures, part of Invest Detroit, was established in 2010 and focuses on nurturing the entrepreneurial ecosystem in Detroit and Michigan. With a commitment to fostering scalable businesses, the firm has invested in over 300 companies, aiming to support every entrepreneur with capital, mentorship, and community engagement. The firm targets early-stage investments in sectors like alternative energy, media, mobility, IT, and life sciences, with $20 million in assets under management. ID Ventures emphasizes an inclusive investment approach, supporting minority, immigrant, and women entrepreneurs.

Headquarters: USA

Investment Geography: USA, specifically Detroit and throughout Michigan

Operating since: 2010

Stages: Pre-Seed, Seed, Series A

Investment Focus: Advanced Materials & Manufacturing, Medical Devices, MedTech, Life Sciences, BioTech, Biopharma, HealthTech, Digital Health, Drones, CPG, Consumer Brands, Retail, Enterprise Software, Cloud Computing, AdTech, MarTech, FoodTech, AgTech, AI, Data Analytics, Data Science, Fashion, AR, MR, Logistics, Supply Chain, FinTech, InsurTech, E-commerce, AutoTech, HRTech, EdTech, Energy, Mobility

Number of investments: 325

Number of exits: 80

Check size: $100k – $1m

Notable investments: Workit Health, Genomenon, Akadeum Life Sciences

Founders/Key People: Martin Dober, Patti Glaza

Website: http://www.idventures.com/

Impact Venture Capital

Impact Venture Capital (Impact VC) is focused on investing in startups and companies that aim to generate both financial returns and positive social or environmental impacts. This investment strategy is grounded in the belief that financial success can be aligned with solutions to global challenges, such as climate change, healthcare, education, and financial inclusion.

Headquarters: Japan.

Investment Geography: United States, Japan, Canada

Operating since: 2016

Investment Focus: AI (Enterprise Software, Cloud Computing, Big Data, Cyber Security, IoT, Robotics, Drones, Autonomous Vehicles, Digital Health, HealthTech, FinTech, FoodTech, AgTech, Retail, Supply Chain, Digital Media)

Stages: Seed, Series A, Series B

Number of investments: 49

Number of exits: 3

Check size: $100K – $5M

Notable investments: TaskHuman, CORNAMI

Founders/Key People: Jonathan Carmel, Gary Hooper

Website: https://impactvc.com/

Inovo Venture

Inovo Venture Partners, known as Inovo VC, is a Polish venture capital firm focused on supporting early-stage tech companies in Poland and the Central and Eastern Europe (CEE) region. Inovo VC aims to back ambitious startups that have the potential to become global market leaders, providing not just financial support but also strategic guidance and access to a broad network of partners and co-investors.

Headquarters: Poland

Investment Geography: Poland, United States, United Kingdom, Slovakia, Sweden, Netherlands, France, Ukraine, Denmark,

Operating since: 2012

Investment Focus: Enterprise Software, Infrastructure, Cloud, AI, Data Analytics, AR, VR, MarTech, Digital Health, HealthTech, MedTech, RetailTech, Consumer Internet, E-commerce, Fashion, Gaming, FoodTech, Dev Tools, PropTech, Marketplaces

Stages: Seed, Series A.

Number of investments: 52

Number of exits: 2

Check size: $500k – $5m

Notable investments: Preply, Booksy

Founders/Key People: Michal Rokosz

Website: https://inovo.vc/

Intres Capital Partners

Intres Capital Partners is a venture capital firm based in Kuala Lumpur, Malaysia, established through a collaborative effort among Malaysia Venture Capital Management Berhad (MAVCAP), QuestMark Capital Management Sdn Bhd, and Teak Capital Sdn Bhd. The firm is actively involved in managing the Axiata Digital Innovation Fund, a technology venture fund initiated by Axiata Berhad in conjunction with MAVCAP. This fund, starting at RM70 million, aims to support innovative and high-growth companies from early stages (Series A) onwards, with potential investments of up to RM10 million per company.

Headquarters: Malaysia

Investment Geography: Malaysia, United States.

Operating since: 2014

Investment Focus: Enterprise Software, E-commerce, FoodTech, Big Data, Data Analytics, IoT, Drones, Hospitality, FinTech, Location-based Services, TravelTech, EdTech, Logistics, Marketplaces.

Stages: Seed, Series A.

Number of investments: 8

Number of exits: 1

Check size: $100K – $1m

Notable investments: Softinn, EASYUNI

Founders/Key People: Sarah Shafii

Website: http://www.intrescapital.com/

Inventure Ventures

Inventure Capital is a boutique investment fund focusing on early-stage investments in tech, biotech, and clean tech startups, primarily in the Midwest. Their portfolio also includes multi-family apartment development, aiming for a mix of tax-efficient, cash-flow-generating real estate and long-term technology investments. The fund has invested in healthcare technologies, a mobile authentication platform, and clean water technology for the oil & gas industry. They also provide consulting and advisory services, including financial analysis and due diligence research.

Headquarters: Finland

Investment Geography: Finland, Sweden, United States, United Kingdom, Germany, Denmark, Latvia, Estonia, Iceland, Hungary, China, Netherlands.

Operating since: 2007