230+ Best Venture Capital (VC) Firms That Invest In E-commerce Startups

Looking for a VC firm that really gets the hustle of the e-commerce world? This guide is your golden ticket. We’ve rounded up the best venture capital investors who are not just deep-pocketed but also bring loads of experience and insight specific to e-commerce.

These are the folks who understand the rapid pace, tech-savvy, and innovation needed to stand out in the digital marketplace. From early-stage startups to scaling giants, we spotlight VC firms with a track record of backing e-commerce winners. Dive in and find your ideal financial partner who’s as excited about your online venture as you are.

- Amplify LA

Amplify LA, founded in 2011 and based in Los Angeles, California, is a pre-seed fund dedicated to supporting strong startups at the earliest stages of their journey. They specialize in making early-stage investments in technology, e-commerce, mobile, healthcare, fintech, gaming, enterprise, and SaaS. Amplify is known for backing LA startups and is a prominent player in the Los Angeles technology scene.

Headquarters: United States

Investment Geography: USA

Operating since: 2011

Stages: Pre-Seed, Seed

Investment Focus: B2B/Enterprise Software, Consumer Products, Consumer Services, FinTech, CyberSecurity, Blockchain, eSports, Gaming, E-commerce, Retail, Fashion, Digital Health, HealthTech, FoodTech, HRTech, Automobile, Marketplaces

Number of investments: 158

Number of exits: 51

Check size: $100k – $10 million

Notable investments: Cascade, Fleet Defender

Founders/Key People: Paul Bricault, Oded Noy

Website: http://amplify.la

- Azure Capital Partners

Azure Capital Partners is a popular early-stage VC firm in San Francisco. They specialize in identifying and investing in late-stage information technology companies. The firm is well-regarded for its industry thought leadership and uses a data-guided approach to strategic decision-making. Azure Capital Partners is generally involved in deals ranging from $10 million to $50 million. The average startup value when Azure Capital Partners invests is between $5 million and $10 million.

Headquarters: USA

Investment Geography: USA, UK, Canada, Spain, Indonesia, Australia

Operating since: 2000

Stages: Post-Seed, Series A, Series B

Investment Focus: Enterprise Software, Enterprise Infrastructure, Hardware, AI, ML, Data Analytics, FinTech, Telcom, CyberSecurity, Digital Media, Gaming, E-commerce, Retail, EdTech, HealthTech, MarTech, Consumer Products, Personal Care, Beauty, Fashion, Dating, Social, Semiconductors, AgTech, BioTech, LegalTech, HRTech, TravelTech, AR, VR, Marketplaces

Number of investments: 200

Number of exits: 78

Check size: $200k – $5m

Notable investments: Native, Clutch

Founders/Key People: Paul Ferris, Mike Kwatinetz

Website: http://www.azurecap.com

- Beacon Capital

Beacon Capital, based in London, United Kingdom, is a venture capital firm focused on early-stage technology companies that are poised to revolutionize enterprise digitization and global competition. Beacon Capital is dedicated to investing in enterprises with strong entrepreneurial vision and exceptional technical talent. The firm’s investment strategy typically involves providing 30-50% of the capital in funding rounds ranging between £1 million to £3 million. Beacon Capital prefers to commit early and often leads the funding rounds.

Headquarters: UK

Investment Geography: USA, UK, Spain, New Zealand, Taiwan

Operating since: 2020

Stages: Post-Seed, Pre-Series A, Series A

Investment Focus: Enterprise Tech (Enterprise Software, Bioinformatics, E-commerce, GovTech, Learning, Marketing, On-Device Software, Ops & Services)

Number of investments: 6

Number of exits: 0

Check size: $500k – $3m

Notable investments: Lifebit, Topia

Founders/Key People: Maria D. Taylor, Tom Canning

Website: http://www.beaconcapital.co.uk

- 1984 Ventures

1984 Ventures specializes in seed-stage investments, particularly focusing on founders with a strong engineering culture who are addressing real-world problems across various industries.

They lean towards companies operating in diverse areas such as e-commerce, supply chain management, proptech, and healthcare. The VC firm supports founders with recruiting, fundraising, and founder therapy.

Headquarters: USA

Investment Geography: USA, Mexico, Canada, Chile, Egypt, Netherlands, Colombia, Australia

Operating since: 2017

Investment Focus: Software (E-commerce, Supply Chain, PropTech, FinTech, HealthCare, SaaS, Consumer, Marketplaces, Staffing)

Stages: Seed

Number of investments: 104

Number of exits: 3

Check size: $500k – $1million

Notable investments: Postscript, Kyte, FairMarkIT

Founders/Key People: Ramy Adeeb, Aaron Michel

Website: https://1984.vc/

- 3TS Capital Partners

3TS Capital Partners is a prominent European venture capital and private equity firm focusing on technology. 3TS focuses on high-growth small and medium-sized enterprises (SMEs), which are either proven businesses becoming local leaders or innovative global challengers.

The firm has managed funds totaling over €400 million, with investors including the European Investment Fund (EIF). The firm is stage-agnostic in its investments, typically investing in the range of €300,000 to €10 million to finance expansion plans, acquisitions, and buyouts.

Headquarters: Austria

Investment Geography: Austria, USA, Poland, Romania, Czech Republic, Netherlands, France, Finland, Germany, UK, Bulgaria, Slovakia

Operating since: 1999

Investment Focus: Technology & Internet (Software, Hardware, Mobile, E-commerce), Media & Communications (Digital Media, Operators), Tech-Enabled Services (Consumer & Business Services, HealthCare Services)

Stages: Series A, Series B

Number of investments: 81

Number of exits: 21

Check size: $300k – $10million

Notable investments: LogMeIn, ShiftMed,

Founders/Key People: Pekka Mäki, Zbigniew Lapinski

Website: https://3tscapital.com/

- Acton Capital

Acton Capital is a VC firm based in Munich focusing on investing in tech startups across Europe and North America. Regarding their financial moves, Acton Capital announced the closing of its sixth venture capital fund at €225 million in November 2023, aimed at investing in tech-enabled businesses in legal technology, hybrid work, cybersecurity, and AI-driven solutions.

Headquarters: Germany

Investment Geography: Germany, USA, Canada, UK, France, Sweden, Russia, Netherlands, Israel, Finland, Switzerland, Estonia, Belgium

Operating since: 1999

Investment Focus: Tech-enabled Business Models (Platform/Marketplaces, Enterprise/B2B Services, Software/SaaS, AdTech, Consumer Health, Consumer Internet, E-commerce, Consumer Brands, D2C)

Stages: Series A, Series B, Series C

Number of investments: 122

Number of exits: 57

Check size: $10m-15m

Notable investments: Clio, Etsy

Founders/Key People: Dominik Alvermann, Dr. Hannes Blum

Website: https://actoncapital.com

- Act Venture Capital

ACT Venture Capital, based in Dublin, Ireland, is a VC firm focusing on tech companies. It’s a pretty dynamic player in the VC world, known for investing in early-stage startups. The team has been working together for over 20 years, fostering a culture of strong internal relationships and shared values. They are usually involved in 2-6 investment rounds annually.

Headquarters: Ireland

Investment Geography: Ireland, USA, UK, China, Singapore, Spain, Germany, Turkey, Greece, Australia

Operating since: 1994

Investment Focus: TECH (Big Data & Analytics, Customer Management, FinTech, E-commerce, Consumer Internet, Mobile, Productivity, Security/CyberSecurity, Enterprise/B2B, Software/SaaS, IT Infrastructure, Communications)

Stages: Seed, Series A, Series B

Number of investments: 200

Number of exits: 79

Check size: $ 1m-10m

Notable investments: Virgin Media, Decawave

Founders/Key People: Debbie Rennick, John Flynn

Website: https://actventure.capital

- Almaz Capital

Almaz Capital, established in 2008 and based in Portola Valley, California, is a venture capital firm that targets technology sectors across Russia and the United States. The firm is known for investing in tech startups that are addressing global markets, with a particular focus on later-stage companies. Almaz Capital Fund II, one of their funds, prefers to invest between $10 to 40 million. This allows them to make substantial investments, supporting companies with significant growth potential.

Headquarters: USA

Investment Geography: USA, Russia, Switzerland, Latvia, Austria, Poland, Germany, Sweden, Belgium, Ukraine, Japan, Hong Kong

Operating since: 2008

Stages: Series A, Series B, Series C

Investment Focus: DeepTech Enterprise Software (AI/ML, Big Data, Data Analytics, BI, Blockchain Apps, IoT, Edge Computing Enablers, CyberSecurity, AdTech, MarTech, Gaming, E-commerce, TravelTech, Mobility, PaaS, eSports, Telecom, Marketplaces)

Number of investments: 90

Number of exits: 33

Check size: $10-40m

Notable investments: Yandex, Acronix

Founders/Key People: Alexander Galitsky, Charlie Ryan

Website: https://almazcapital.com/

- Alpaca VC

Alpaca VC, founded in 2013 and based in New York, focuses on investing in pre-seed and seed-stage companies. Regarding their investment check size, Alpaca VC typically invests between $500k and $2 million for early-stage startups and up to $5 million for mid-stage companies. This range is consistent across their funds, including Alpaca VC Fund III. It also prefers investments within this range, aiming to invest in a minimum of 30 companies over the next 3 to 4 years.

Headquarters: USA

Investment Geography: USA, UK, Canada, Israel, Belgium, Australia, New Zealand

Operating since: 2013

Stages: Pre-Seed, Seed (Lead), Series B

Investment Focus: Consumer (Personalization, Wellness & Luxury Goods), Subscription Commerce (Payment Processing Software, Marketplaces, E-commerce Tools), Virtual Communities (Digital Products/Services), FemTech (Child Care, Elderly Care, Women’s Health), PropTech (Branded Living/Working, Smart Buildings/Homes, Home Ownership), B2B Marketplaces, Global Commerce Infrastructure

Number of investments: 114

Number of exits: 28

Check size: $ 500k-10m

Notable investments: OpenSpace, Zopa

Founders/Key People: Ryan Freedman, Aubrie Pagano

Website: https://alpaca.vc

- Backstage Capital

Backstage Capital is a venture capital firm that invests in startups led by underrepresented founders, including women, people of color, and LGBTQ+ founders. The firm is dedicated to reducing funding disparities in technology by supporting high-potential founders from these groups. Backstage Capital primarily invests in pre-seed and seed-stage startups. Regarding investment amounts, Backstage Capital has been investing amounts ranging from $25,000 to $100,000 in companies with diverse founders.

Headquarters: USA

Investment Geography: USA, UK, Canada

Operating since: 2015

Stages: Pre-Seed, Seed, Series A

Investment Focus: Underrepresented Founders (Women, People of Color, LGBTQ): (Software, Enterprise/B2B, Blockchain, FinTech, EdTech, Consumer Tech, Consumer Goods, DTC, E-commerce, FoodTech, Gaming, Digital Health, Digital Media, SaaS, Marketplaces)

Number of investments: 205

Number of exits: 43

Check size: $25k – $100k

Notable investments: Dollaride, Hello Alice, Fairly AI

Founders/Key People: Arlan Hamilton, Christie Pitts

Website: https://backstagecapital.com

- Beco Capital

BECO Capital is a prominent VC firm based in Dubai, United Arab Emirates. It is one of the first VC firms founded in the UAE, focusing on the Middle East and North Africa (MENA) region. BECO Capital has become one of the largest non-governmental venture firms in the region, boasting approximately $450 million in assets under management. BECO Capital provides growth capital and hands-on operational mentorship to its portfolio companies, fostering their development and scaling in the MENA market.

Headquarters: UAE

Investment Geography: UAE, USA, UK, France, Egypt, Saudi Arabia, Singapore, Kuwait, Turkey, Jordan, Germany, Bahrain, Canada

Operating since: 2012

Stages: Late Seed, Pre-Series A, Series A

Investment Focus: Enterprise Software, PropTech, FinTech, InsurTech, HRTech, Mobility, Transportation, Marketplaces, eSports, E-commerce, CyberSecurity, HealthTech, FoodTech, AR/VR, Construction

Number of investments: 98

Number of exits: 17

Check size: $10-50m

Notable investments: Tribal, Careem

Founders/Key People: Abdulaziz Shikh Al Sagha, Dany Farha

Website: https://becocapital.com

- Blossom Street Ventures

Blossom Street Ventures is a Dallas, Texas-based venture capital firm primarily investing in the SaaS and technology sectors. The firm focuses on mid-stage venture opportunities, defining this as companies with monthly revenues of $100k to $1m and exhibiting attractive year-over-year growth (50%+). They invest in both B2B and B2C models, including enterprise software, e-commerce, and services. Blossom Street Ventures is active in the Big Data and analytics sectors and has a diverse portfolio, including companies like Celigo and TextUs.

Headquarters: USA

Investment Geography: USA, UK,

Operating since: 2013

Stages: Series A, Series B

Investment Focus: Software, Marketplaces, E-commerce

Number of investments: 47

Number of exits: 13

Check size: $1m – $4m

Notable investments: Unite Us, Cordial,

Founders/Key People: Sammy Abdullah, Jake Connelly

Website: https://blossomstreetventures.com

- Bow Capital

Bow Capital is an innovative venture capital firm that blends academia, business, and entertainment in its investment approach. Primarily, Bow Capital focuses on early-stage investments, particularly in Series A and B rounds, demonstrating a commitment to nurturing emerging technologies and business models. The firm was founded in partnership with the University of California, showcasing a commitment to integrating academic research and innovation into the VC landscape.

Headquarters: USA

Investment Geography: USA, Canada

Operating since: 2016

Stages: Series A, Series B

Investment Focus: CONSUMER, E-commerce, DTC, EdTech, ENTERPRISE, Software, Data Analytics, Logistics, Science, BioTech, FoodTech, AgTech, CleanTech, Consumer and B2B Marketplaces

Number of investments: 63

Number of exits: 9

Check size: $500k – $10m

Notable investments: ClearCo, Evolve BioSystems

Founders/Key People: Grady Burnett, Raymond Dong

Website: https://bowcapital.com

- C4 Ventures

C4 Ventures is a top European VC firm, founded in 2012 and co-founded by Pascal Cagni, former VP & GM of Apple EMEIA. The firm is based in Paris, with an additional presence in London. It is well-known for its leadership team of former Apple and Microsoft executives, and it focuses on backing ambitious tech entrepreneurs. C4 Ventures’ approach goes beyond mere financial investment; it emphasizes creating value through deep understanding, strong involvement, and concrete operational support. Their investment portfolio is particularly focused on European smart hardware.

Headquarters: France

Investment Geography: Denmark, USA, UK, Sweden, Germany, Finland, Estonia, Iceland, Lithuania

Operating since: 2012

Stages: Seed, Pre-Series A, Post-Series A

Investment Focus: Smart Hardware, Future of Commerce/E-commerce, Digital Media, Future of Work/Software

Number of investments: 66

Number of exits: 19

Check size: $100K – $10M

Notable investments: Graphcore, Drivenets

Founders/Key People: Pascal Cagni, Mathieu Bourdie

Website: https://c4v.com

- Charge Ventures

Founded in 2015, Charge Ventures is located in New York. The firm invests in pre-seed and seed-stage companies in sectors like artificial intelligence, machine learning, healthcare, and technology. Charge Ventures is noted for partnering with founders at the earliest stages, focusing on companies addressing future-oriented problems. The firm generally participates in funding rounds of less than $2 million for companies that have raised less than $2 million.

Headquarters: USA

Investment Geography: USA, Tonga, Greece, Saint Kitts and Nevis

Operating since: 2015

Stages: Pre-Seed, Seed

Investment Focus: SaaS, Mobile, E-commerce, Social Media, Enterprise Software, FinTech, HealthCare, Medical Devices, Open Source, Marketplaces, AI, Mobility, Cryptocurrency, Blockchain, Future Of Work

Number of investments: 76

Number of exits: 15

Check size: $1m to $5m

Notable investments: Electric, Republic,

Founders/Key People: Chris Habachy, Jinghan H.

Website: https://charge.vc

- ClalTech (CVC)

Founded in 2014, ClalTech is the corporate venture capital investment arm of Clal Industries, based in Tel Aviv, Israel. The firm prefers to make minority investments in later-stage companies, focusing primarily on the software sector in Israel. ClalTech is known for investing in technology companies at any stage, focusing on fintech, internet, and e-commerce. The average startup value when ClalTech invests is between $500 million and $1 billion. The fund is actively involved in 2-6 investment rounds annually.

Headquarters: Israel

Investment Geography: Israel, USA

Operating since: 2014

Stages: Series B, Series C, Series D

Investment Focus: Enterprise Tech, Consumer Tech, Enterprise Software, Cloud Infrastructure, FinTech, Internet, E-commerce, CyberSecurity, Gaming, MarTech

Number of investments: 30

Number of exits: 8

Check size: $50m – $100m

Notable investments: Yotpo, Vayyar

Founders/Key People: Daniel Shinar, Mor Grabli

Website: https://claltech.com

- Cocoon Capital

Established in 2016, Cocoon Capital is a venture capital firm headquartered in Singapore.

The firm invests in early-stage companies operating in Southeast Asia’s B2B enterprise and deep tech sectors. Cocoon Capital supports a range of sectors including B2B, B2C, SaaS, e-commerce, and FinTech companies.

Headquarters: Singapore

Investment Geography: Singapore, USA, Vietnam, Philippines, Indonesia, Burma (Myanmar), Australia

Operating since: 2016

Stages: Seed, Series A

Investment Focus: Enterprise (Software, SaaS, Enterprise IT, AI, Big Data, Data Analytics, Business Intelligence, FinTech, CyberSecurity, AdTech, MarTech, HealthTech, E-commerce, Logistics, Supply Chain, MedTech, PropTech, EventsTech, Marketplaces)

Number of investments: 52

Number of exits: 4

Check size: $100k – $1m

Notable investments: Buymed, SensorFLow

Founders/Key People: Will Klippgen, Zong Sia

Website: https://cocooncap.com

- Comcast Ventures (CVC)

Comcast Ventures is the private venture capital affiliate of Comcast Corporation. Founded in 1999 and based in San Francisco, Comcast Ventures invests in innovative businesses that are shaping the future of entertainment, communications, and digital technology. The firm partners with entrepreneurs who demonstrate vision, passion, and tenacity.

Headquarters: USA

Investment Geography: Singapore, USA, Israel, Canada, UK, Germany, Finland, Singapore, Sweden, France, Ghana, UAE, China

Operating since: 1999

Stages: Seed, Series A, Series B, Series C, Series D

Investment Focus: Enterprise (Enterprise Software, Cloud Infrastructure, CyberSecurity, Data Analytics, Business Intelligence, FinTech, InsurTech, Blockchain, Marketplaces, Digital Media, MarTech, AdTech, Telecommunication, Wireless, Data, LegalTech, Future of Work, Mobile, HRTech, HealthTech, IoT, AI, EdTech, Robotics, Drones, TravelTech, Hardware), Consumer (Consumer Brands, SaaS, E-commerce, Automotive, RetailTech, Fashion, Personal Care, Mobility, PropTech, Hardware, Beauty, Gaming, Sports, eSports, VR, AR, Content, FoodTech, Social)

Number of investments: 482

Number of exits: 200

Check size: $2m – $100m

Notable investments: Datadog, Slack, Instacart

Founders/Key People: Ryan Lee, Allison Goldberg

Website: https://comcastventures.com

- Compound

Compound VC is a New York City-based venture capital firm primarily investing in early-stage technology companies. Established in 2009, the firm leverages its team’s expertise in investing, research, and operations to support founders in solving complex technical challenges, effectively communicating their breakthroughs, and scaling their commercial efforts. The team at Compound VC includes individuals with diverse roles and experiences, such as Michael Dempsey and David Hirsch, who contribute to the firm’s strategic and operational guidance.

Headquarters: USA

Investment Geography: USA, Singapore, Germany, UK, France, Canada, Singapore, Spain, Australia,

Operating since: 2006

Stages: Seed, Series A

Investment Focus: AI/ML, Health Care & Biology, Robotics/Connected Devices/IoT, FinTech, Enterprise Software, Blockchain, E-commerce, Consumer Mobile, Marketplaces

Number of investments: 237

Number of exits: 99

Check size: $1m – $30m

Notable investments: Genies, Thrive Market

Founders/Key People: Michael Dempsey, David Hirsch

Website: https://compound.vc

- Correlation Ventures

Correlation Ventures is a venture capital firm known for its efficient decision-making process and flexible investment approach. They offer a transparent and efficient process for startups, focusing on maintaining the founders’ focus on their business. The firm provides flexible check sizes ranging from $100,000 to $4 million. Correlation Ventures prides itself on its data-driven fundraising approach and strong relationships in the industry, helping startups find the right investors and partners quickly. The firm boasts one of the industry’s broadest portfolios, connecting companies to a network of potential customers, partners, and mentors.

Headquarters: USA

Investment Geography: USA, Germany, Switzerland, Canada, India, Nigeria

Operating since: 2006

Stages: Seed,Series A,Series B

Investment Focus: Consumer,Enterprise,FinTech,InsurTech,Payments,Wealth Management, Health Care, BioTech, Biopharma, Therapeutics, MedTech, EdTech, E-commerce, FoodTech, DTC, Fashion, Food & Beverages,Digital Media,Gaming, Mobility, AI, Data Analytics, Cloud Infrastructure, Software, Digital Health,HealthTech, VR, CyberSecurity, Dev Tools, MarTech, HRTech, Logistics,Real Estate,PropTech, RetailTech,Semiconductors, Energy

Number of investments: 503

Number of exits: 162

Check size: $100k – $4m

Notable investments: New Relic, Synthorx

Founders/Key People: David Coats, Trevor Kienzle

Website: https://correlationvc.com

- Ludlow Ventures

Ludlow Ventures is a venture capital firm that operates with a philosophy of “VC without ego.” The team at Ludlow Ventures focuses on building authentic friendships with the entrepreneurs they invest in, emphasizing trust and close relationships. The firm is deeply involved in the startup journey, providing more than just financial support. They assist in product testing, leveraging their network, and enhancing market reach for the startups they back.

Ludlow Ventures targets investments in the idea/pre-seed and seed stages, indicating a focus on early-stage companies. Their investment approach is characterized by “insane conviction,” moving quickly to back teams even when it may seem too early for other investors.

Headquarters: USA

Investment Geography: USA, Canada, UK, Australia.

Operating since: 2009

Investment Focus: Mobile, Software, Internet, E-commerce, Fashion, Marketplaces, eSports.

Stages: Seed, Series A, Series B+.

Number of investments: 157

Number of exits: 31

Check size: $150K – $1M

Notable investments: AngelList, Honey.

Founders/Key People: Brett Demarrais, Jonathan Triest

Website: https://ludlowventures.com

- Lofty Ventures

Lofty Ventures is a venture capital firm with a strong focus on founder development. The firm does not have a specific diversity mandate but highlights that nearly three-quarters of its startups are led by underrepresented founders, emphasizing its belief in the benefits of a diverse startup community.

Lofty Ventures prides itself on investing in startups with founders who are brilliant, scrappy, gritty, coachable, and passionate about solving problems. The firm is industry agnostic, preferring to invest in products that contribute to community building or personal use.

Headquarters: USA

Investment Geography: United States, Canada, Gibraltar.

Operating since: 2014

Investment Focus: E-commerce,Web Apps,Mobile Apps,Enterprise Software,Consumer Products.

Stages: Pre-Seed, Seed, Series A.

Number of investments: 88

Number of exits: 5

Check size: $10k – $1m

Notable investments: Paladin, Gunslinger.

Founders/Key People: Christopher Deutsch, Ryota Sekine

Website: https://loftyventures.com

- M13

M13 is an early-stage consumer tech venture capital firm that supports its founding teams with full-time operating partners, resources, and networks. Founded in 2016 and based in Santa Monica, California, M13 invests in technology, work, health, commerce, and money sectors. The firm is notable for its focus on consumer products and services (both B2C and B2B), financial services, media, e-commerce, and cryptocurrency sectors.

Headquarters: USA

Investment Geography: USA, Canada, Germany, Mexico, Australia.

Operating since: 2016

Investment Focus: Consumer Internet & Media,E-commerce,Cannabis,FoodTech, Consumer Tech, FinTech, EdTech, Digital Health/HealthTech, Housing/PropTech, B2B/Enterprise, SaaS/Software, Logistics & Transportation/Mobility

Stages: Pre-seed, Seed, Series A, Series B+.

Number of investments: 141

Number of exits: 22

Check size: $100K – $10M

Notable investments: Shef, FanDuel, Delphia.

Founders/Key People: Courtney Reum, Latif Peracha

Website: https://m13.co

- M25

M25 is an early-stage venture firm based in Chicago, specializing in investing in tech startups headquartered in the Midwest. Established in 2015, M25 has become the most active investor in its region. M25 is known for its concentration on Series A investments and has made significant strides in diversifying its investment portfolio.

Headquarters: USA

Investment Geography: USA, Sweden.

Operating since: 2015

Investment Focus: Big Data Analytics & IoT,Consumer Apps, E-commerce, EdTech, GovTech & LegalTech,Enterprise/B2B,SaaS/Software,Media & Entertainment & Sports, FinTech & Banking, Food & Beverage/FoodTech,Digital Health/HealthTech Hardware, MarTech/AdTech, Real Estate/PropTech,Transportation & Logistics

Stages: Pre-seed, Seed, Series A, Series B+.

Number of investments: 194

Number of exits: 20

Check size: $1M – $3M

Notable investments: Axuall, Astronomer, Branch App.

Founders/Key People: Mike Asem, Victor Gutwein

Website: https://m25vc.com

- MaC Venture Capital

MaC Venture Capital, established in 2019, is a venture capital investment firm headquartered in Los Angeles, California. MaC Venture Capital invests in technology startups that leverage shifts in cultural trends and behaviors, providing both financial support and strategic guidance

Headquarters: USA

Investment Geography: United States, Nigeria, Kenya, France, Germany, Ghana, Switzerland, Canada, Mexico.

Operating since: 2019

Investment Focus: Consumer Internet,FinTech,EdTech,Digital Health,Digital Media, E-commerce, Logistics/Infrastructure,Mobile,Services,Regulatory,Productivity,SaaS/Software, B2B/Enterprise.

Stages: Pre-seed, Seed, Series A, Series B.

Number of investments: 225

Number of exits: 18

Check size: $500K – $3M

Notable investments: Pipe, Genies

Founders/Key People: Michael Palank, Marlon Nichols

Website: https://macventurecapital.com

- Maor Investments

Maor Investments is a Luxembourg-based venture capital firm established in 2017 with a strategic focus on investing in Israeli technology startups. Maor Investments targets companies with established proof of concept and a need to scale up, thereby focusing on businesses that have already demonstrated some level of viability and are ready for growth. The firm’s approach is specifically tailored towards nurturing the growth and development of these startups, leveraging its expertise and resources to drive their success in the technology sector.

Headquarters: Luxembourg

Investment Geography: United States, Israel, Netherlands, United Kingdom, Northern Mariana Islands.

Operating since: 2017.

Investment Focus: Israeli Tech (SaaS, Enterprise Software,AI,Business Intelligence, Data Analytics, FinTech,MarTech,Cyber Security,HealthTech,E-commerce,Real Estate Tech,Digital Media,Sports, EventTech).

Stages: Pre-seed, Seed, Post-Seed, Series A, Series B+.

Number of investments: 24

Number of exits: 2

Check size: $3M – $5M

Notable investments: Caralogix, Bizzabo.

Founders/Key People: Philippe Guez, Ido Hart

Website: https://maorinvestments.com

- March Capital

March Capital is a venture-growth firm headquartered in Santa Monica, California, and has been investing globally since 2014. This top-tier venture capital and growth equity firm focuses intensely on sector-specific investments. They aim to accelerate founder success by leveraging a global leadership network and engaging deeply with their portfolio companies. March Capital invests in areas like enterprise AI, fintech, cloud/data infrastructure, and gaming.

Headquarters: USA

Investment Geography: United States, India, United Kingdom, Germany, Israel, Türkiye

Operating since: 2014.

Investment Focus: B2B Software/SaaS,Enterprise AI,Cyber Security,FinTech,Data Infrastructure, E-commerce Enablement,Gaming.

Stages: Pre-seed, Seed, Post-Seed, Series A, Series B+.

Number of investments: 132

Number of exits: 18

Check size: $500K – $10M

Notable investments: CrowdStrike, KnowBe4

Founders/Key People: Jamie Montgomery, Sumant Mandal

Website: https://marchcp.com

- Mendoza Ventures

Mendoza Ventures, established in 2016, is a venture capital firm based in Boston, Massachusetts, specializing in early and growth-stage investments. The firm is particularly focused on the Fintech, AI, and Cybersecurity sectors. Mendoza Ventures stands out for its actively managed approach to venture capital, investing in areas where the team has substantial domain expertise.

Headquarters: USA

Investment Geography: USA, UK, Canada.

Operating since: 2016.

Investment Focus: AI, FinTech, CyberSecurity, Blockchain, SaaS, E-commerce.

Stage: Pre-Seed, Seed, Post-Seed, Series A.

Number of investments: 15

Number of exits: 2

Check size: $100K – $5M

Notable investments: SensoAI, FiVerity

Founders/Key People: Susana Hirs, Adrian Mendoza

Website: https://mendoza-ventures.com

- Midven

Midven is a specialist venture capital company based in Birmingham, United Kingdom. Established in 1990, the firm primarily invests in fast-growing small and medium-sized enterprises (SMEs). The firm is part of Future Planet Capital, a global impact investor. It emphasizes empowering entrepreneurs in the West Midlands, fostering collaborations to create a fertile environment for innovative early-stage businesses.

Headquarters: UK

Investment Geography: United Kingdom, United States, Canada, Israel, Egypt.

Operating since: 1991.

Investment Focus: Environmental Tech,Energy,Gas,Semiconductors,Composites,New Materials, Sensors,SpaceTech,Enterprise Infrastructure,Enterprise Software, Digital Media, Content,Telecom,EdTech,FinTech,Cyber Security, Gaming, Manufacturing, MedTech, Medical Devices, BioTech, Diagnostics, Therapeutics,Drug Discovery, HealthTech, FoodTech, AdTech, MarTech, Data Analytics, Business Intelligence, Consumer Brands, E-commerce, Marketplaces.

Stage: Pre-Seed, Seed, Post-Seed, Series A.

Number of investments: 137

Number of exits: 25

Check size: $500K – $1M

Notable investments: Paymob, ScriptSwitch.

Founders/Key People: Rupert Lyle

Website: https://midven.co.uk

- MMC Ventures

MMC Ventures, founded in 2000, is a venture capital investment firm based in London, United Kingdom. The firm has a keen interest in investing in innovative technology sector companies. As one of Europe’s most active early-stage tech investors, MMC Ventures’ investment strategy focuses on sectors such as enterprise AI, fintech, data-driven health, data infrastructure, and cloud. The firm’s portfolio includes various companies that prefer investing in Seed and Series A stages.

Headquarters: UK

Investment Geography: United Kingdom, United States, France, Germany, Spain, Israel, Austria, Denmark, Norway.

Operating since: 2000.

Investment Focus: FinTech/InsurTech,Digital Health,Consumer Internet,Consumer Products, E-commerce, Digital Media/MediaTech,Enterprise/B2B,AI & Data Analytics, SaaS/Software, MarTech, HRTech, CyberSecurity, RetailTech.

Stage: Pre-Seed, Seed, Post-Seed, Series A, Series B+.

Number of investments: 207

Number of exits: 24

Check size: $1M – $27M

Notable investments: Gousto, Synthesia.

Founders/Key People: Bruce Macfarlane

Website: https://mmc.vc

- Modus Capital

Modus Capital, founded in 2015 and based in New York, New York, is a venture capital firm focusing on technology companies across various sectors. The firm operates as a “venture platform” in the MENA region, incorporating VC funds, Venture Builders, and a Corporate Innovation arm. Modus Capital’s approach involves a venture-building program designed to empower founders, which includes a nine-month program for nurturing and launching startups.

Headquarters: Egypt

Investment Geography: United States, United Arab Emirates, Qatar, United Kingdom, Saudi Arabia, Egypt, Canada.

Operating since: 2015.

Investment Focus: Social Impact (SaaS/Software,Enterprise/B2B,Media,Consumer Internet, FinTech, EdTech,Digital Health,MedTech,E-commerce,Consumer Products).

Stage: Pre-Seed, Seed, Post-Seed, Series A.

Number of investments: 19

Number of exits: 1

Check size: $250K – $1M

Notable investments: Ogram, Meddy

Founders/Key People: Kareem Elsirafy

Website: https://modus.vc

- Newfund Capital

Newfund Capital, founded in 2008, is a venture capital firm that specializes in early-stage investments. It is distinguished for being the first early-stage VC based in both Paris and Silicon Valley. With $300 million in assets under management (AUM), Newfund has been a significant player in the venture capital landscape, mainly supported by entrepreneurs and family offices. The firm operates in France and North America, demonstrating a broad geographic reach in its investment strategy.

Headquarters: France

Investment Geography: France, United States, Canada, United Kingdom, Germany, Israel, Belgium, Luxembourg, China, Mauritius, Senegal.

Operating since: 2008

Investment Focus: Enterprise Software,Infrastructure & Networks,Retail, RetailTech, E-commerce, Enterprise, Consumer, Hardware, Energy, CleanTech, FinTech, HealthTech, Marketplaces, EdTech,Construction & Real Estate,FoodTech, HRTech,AdTech,Hospitality, TravelTech, Gaming,Entertainment,Automotive,IoT,NanoTech,Blockchain,Crypto.

Stage: Seed, Post-Seed, Series A, Series B.

Number of investments: 185

Number of exits: 32

Check size: €500K – €2M

Notable investments: Aircall, Zinier

Founders/Key People: Francois Veron, Patrick Malka

Website: https://newfundcap.com/

- NextGen Venture Partners

NextGen Venture Partners, founded in 2012, is a venture capital investment firm based in Baltimore, Maryland. The firm specializes in early-stage investments and primarily invests in technology startups. It supports venture investments and co-leads financings in firms that demonstrate potential for growth.

With a network of over 1700 venture partners who are top entrepreneurs and executives, NextGen Venture Partners provides entrepreneurs with valuable connectivity for sales, hiring, and financing introductions, as well as on-demand advice. This extensive network plays a crucial role in the firm’s strategy, enhancing the growth and development of the companies it backs.

Headquarters: USA

Investment Geography: USA, Mexico.

Operating since: 2012.

Investment Focus: Enterprise Software,Automation Software,Digital Health, EdTech, FinTech, Logistics, Cyber Security,HRTech,PropTech,Consumer Internet, E-commerce, Marketplaces, Mobility, Robotics

Stage: Seed, Post-Seed, Series A, Series B+.

Number of investments: 101

Number of exits: 16

Check size: $500K – $2M

Notable investments: Convey, Clear Street

Founders/Key People: Jon Bassett, Chris Keller

Website: https://nextgenvp.com

- Northzone

Northzone Ventures, founded in 1996, is a venture capital firm based in London, United Kingdom. The firm invests in Europe and the United States, focusing on sectors such as healthcare, semiconductors, software, hardware, artificial intelligence, blockchain, and gaming. As a multi-stage venture capital fund, Northzone invests at various stages, including early-stage venture, late-stage venture, and seed stages. The firm’s approach is shaped by the experience of its team members as both entrepreneurs and investors, and it aims to invest in companies that hold promise for substantial growth and innovation in their respective fields.

Headquarters: UK

Investment Geography: United States, Sweden, United Kingdom, Norway, Germany, Finland, Denmark, France, Spain, Netherlands, Türkiye, Russia.

Operating since: 1996.

Investment Focus: Consumer Internet, DTC & E-commerce, FinTech, EdTech, HealthTech, Gaming & Media, Blockchain, SaaS/B2B Software, Enterprise Platforms, Logistics & Mobility, Semiconductors & Materials.

Stage: Seed, Post-Seed, Series A, Series B+.

Number of investments: 357

Number of exits: 68

Check size: $1M – $30M

Notable investments: Spotify, Klarna

Founders/Key People: Tom McGinn, Torleif Ahlsand

Website: https://northzone.com

- LocalGlobe

LocalGlobe is a venture capital firm established in 1999 and headquartered in London, United Kingdom. It specializes in investments across various stages, including seed, early stage, and later stage ventures. The firm focuses on industries such as software and artificial intelligence. Typically, the firm invests in startups that are 2-3 years old and have proven customer base in their respective market.

Headquarters: UK

Investment Geography: United Kingdom, United States, France, Germany, Israel, Ireland, Belgium, Spain, Sweden, Netherlands, Nigeria, Kenya

Operating since: 1999

Investment Focus: Enterprise Software, Cloud Infrastructure, FinTech, InsurTech, Fitness, EdTech, Mobility,Logistics,HealthTech, Retail, E-commerce, Connected Car, PropTech, AI, ML, Data Analytics, AR &VR, Robotics, Blockchain,SpaceTech,Digital Media, Energy, LegalTech, HRTech, JobTech, TravelTech, MarTech, AdTech, IIoT, Fashion, Gaming, FoodTech, Transportation, Marketplaces.

Stages: Seed, Series A, Series B+.

Number of investments: 375

Number of exits: 61

Check size: $200k – $2m

Notable investments: Figma, Robinhood, Algolia.

Founders/Key People: Robin Klein

Website: https://localglobe.vc

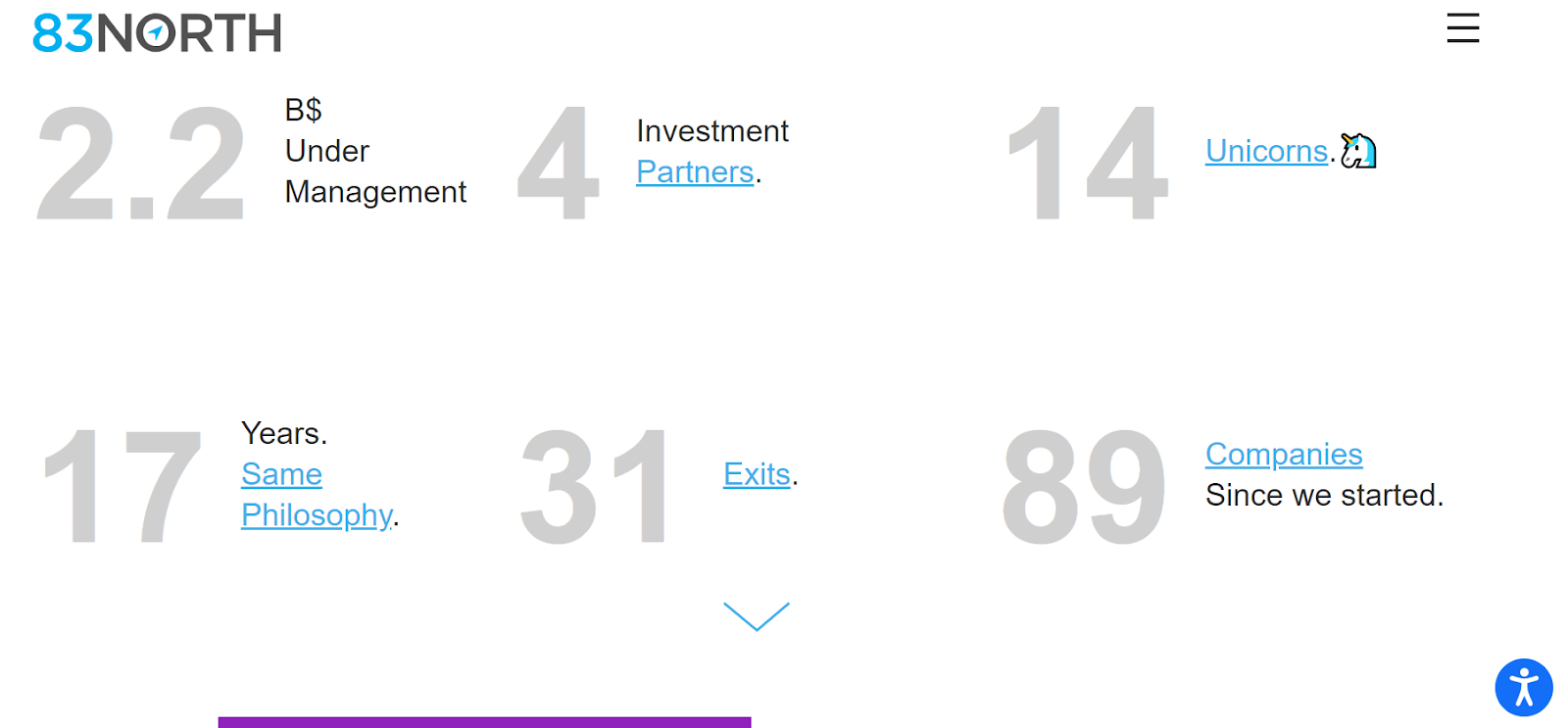

- 83North

83North is a venture capital firm with a significant presence in Europe. The firm operates a lean operation with high levels of trust, leading to transparent and quick processes for entrepreneurs. Despite a focused approach, they invest globally in various segments. They strongly believe that innovation and technology, led by unique individuals, can significantly improve the world. Their goal is to find and work with these innovative individuals

Headquarters: UK

Investment Geography: UK, USA, Israel, Germany, France, Italy, Spain, Ireland, Canada, Netherlands, Finland, Sweden.

Operating since: 2006

Investment Focus: Consumer & Enterprise (FinTech, HealthTech, HW & IOT, IT Infrastructure, Marketplaces/E-commerce, Media/Gaming, Mobility, SaaS & Software, Security)

Stages: Series A, Series B, Series C

Number of investments: 89

Number of exits: 31

Check size: $ 1m – $40m

Notable investments: Paddle, Actifio, Celonis

Founders/Key People: Laurel Bowden, Gil Goren

Website: https://www.83north.com

- AirTree Ventures

AirTree Ventures is a VC firm primarily focused on investing in tech founders from Australia and New Zealand. They are committed to supporting these founders from the start, aiming to be long-term partners. The firm has partnered with over 100 fast-growing and impactful tech companies across various industries. Additionally, they reserve a significant portion of their funds to support their companies in subsequent funding rounds.

Headquarters: Australia

Investment Geography: Australia, USA, UK, Canada, Singapore, New Zealand, Germany, Argentina, Finland, Estonia

Operating since: 2014

Stages: Seed, Series A, Series B

Investment Focus: Tech (Consumer, Data, E-commerce, Education, Energy, Enterprise, Finance, Hardware, Health, Industrials, Infrastructure, Marketplaces, SaaS, Security)

Number of investments: 168

Number of exits: 15

Check size: $200k to $50m

Notable investments: Canva, Linktree

Founders/Key People: Craig Blair, Daniel Petre AO

Website: https://www.airtree.vc

- Antler

Antler started in Singapore in 2017 and has quickly become a big name in the early-stage investment scene. They’re famous for being the go-to investor from the very start, focusing on early-stage companies. By 2023, Pitchbook crowned Antler the most active seed-stage VC firm globally. They’re not just about the numbers; they’re deeply invested in nurturing startups that are changing the game, creating jobs, and making a positive impact. Region-wise, Antler has a strong footing in the Asia-Pacific and Southeast Asian regions, thanks to its Singaporean roots.

Headquarters: Singapore

Investment Geography: Singapore, USA, UK, Australia, Sweden, Netherlands, Indonesia, Norway, Germany, India, South Korea, Denmark, Vietnam, Canada, Kenya, France, Brazil, Pakistan, Finland, Malaysia, Thailand, Portugal, Spain, South Africa, Philippines, UAE,

French-Guiana, Turkey, Mexico, Italy, Nigeria, Czech Republic, Ireland, Slovakia, Japan, Federated States of Micronesia, Lithuania, China, Latvia, British Virgin Islands, Colombia, Estonia, Hong Kong, Kyrgyzstan, Austria, Ethiopia

Operating since: 2017

Stages: Pre-Seed, Seed

Investment Focus: AI/Machine Learning, Consumer Tech, EdTech, Energy, FinTech, Food and AgriTech, HealthTech, HRTech, Logistics and Manufacturing, Media and Communication, Mobility, PropTech, Retail and E-Commerce, SaaS

Number of investments: 1175

Number of exits: 77

Check size: $250k

Notable investments: Xanpool, SuperOrdinary, Airalo

Founders/Key People: Edward Knight, Andrea Hajdu-Howe, Anthony Millet

Website: https://www.antler.co

- August Capital

August Capital is a VC firm established in 1995, based in Menlo Park, California, focusing on the IT sector. The firm, co-founded by David Marquardt and John Johnston, specializes in early-stage, later-stage, and startup investments. They like to invest in infrastructure, data center technologies, systems management, security, storage, and cloud computing systems. The firm manages about $2 billion in aggregate capital commitments.

Headquarters: USA

Investment Geography: USA, UK, Canada, Singapore, Japan, Poland, Ireland

Operating since: 1995

Stages: Seed, Series A, Series B

Investment Focus: AdTech, Aerial Imaging, Big Data and Machine Learning, Blockchain, Branding and Consumer Products, CDN, E-commerce, Enterprise Logistics, Financial Services, IoT, Marketplace Platform, Media and Content, Network Hardware, Networking and Cloud, SAAS, Security, Semiconductors, Social, Software and Systems, Storage Systems, Wireless Communications

Number of investments: 392

Number of exits: 185

Check size: $400k – 2m

Notable investments: Avant, Inrix

Founders/Key People: Buddy Arnheim, Eric Carlborg

Website: https://www.augustcap.com

- B2venture

b2venture is a venture capital firm with a knack for nurturing early-stage companies. They’re big on investing in the early stages of a company’s life. They’re all about spotting potential early and helping it grow. They’ve got a strong network of angel investors. This network spans tech and industry, bringing a load of expertise and hands-on support to the companies they invest in.

Headquarters: Germany

Investment Geography: USA, UK, Israel, Germany, Canada, Netherlands, Brazil, China, Switzerland, Mexico, Spain, Austria, Sweden, Italy, France, India, Finland, Turkey, Belgium, Japan, Malta, Poland, Ireland, Portugal, Australia

Operating since: 2000

Stages: Seed, Series A, Series B

Investment Focus: Digital Tech (Enterprise Software, Cloud Infrastructure, E-commerce, Logistics, TravelTech, Fashion, FoodTech, AI, ML, Data Analytics, Social Network, Digital Health, JobTech, CyberSecurity, Mobility, FinTech, Sports, EdTech, PropTech, LegalTech, Marketplaces), Industrial Tech (Industry 4.0, Resource Efficiency, Industrial AI, IoT, Enterprise Software, MedTech)

Number of investments: 356

Number of exits: 128

Check size: $250k – $5m

Notable investments: OrCam, AI21, XING

Founders/Key People: Chase Gummer, Jochen Gutbrod

Website: https://www.b2venture.vc/

- Baseline Ventures

Baseline Ventures is a VC firm specializing in seed and growth-stage investments in tech. Founded in 2006 by Steve Anderson in San Francisco, California, the firm has been instrumental as the first seed investor in Instagram and an early investor in Twitter. Baseline Ventures is celebrated as one of Silicon Valley’s most successful and smallest investment firms. In terms of investment check size, Baseline Ventures offers checks based on the stage and needs of the startup. Their check sizes range from as low as $0 to $100K, going up to between $100K and $500K, and even as high as $500K to $1M.

Headquarters: USA

Investment Geography: USA, Australia, Canada, Germany

Operating since: 2006

Stages: Seed, Series A

Investment Focus: FinTech, Enterprise/B2B Software, SaaS, CyberSecurity, Robotics, Mobile, Consumer Services, Digital Health, EdTech, Fashion, E-commerce, FoodTech, Gaming, Social, Marketplaces

Number of investments: 238

Number of exits: 102

Check size: $10k – $1m

Notable investments: SoFi, Instagram, Twitter

Founders/Key People: Steve Anderson,

Website: https://www.baselinev.com

- Bull City Venture Partners

Bull City Venture Partners is a venture capital firm specializing in early-stage investments. They focus on sectors such as software, mobile, e-commerce, health, and the internet. Their investment approach is known for being particularly hands-on, often taking board seats in the companies they invest in. Bull City Venture Partners have been active in the venture capital scene with a notable presence in the Mid-Atlantic and Southeast regions of the United States. Notably, in May 2022, they closed their oversubscribed fourth fund, securing $53 million in capital commitments.

Headquarters: USA

Investment Geography: USA, Kuwait

Operating since: 2012

Stages: Seed, Series A, Series B

Investment Focus: Enterprise Software, Cloud Infrastructure, Internet, Mobile, AI, Data Analytics, AdTech, MarTech, CyberSecurity, FinTech, EdTech, Health Care IT, HealthTech, IoT, E-commerce, Marketplaces

Number of investments: 62

Number of exits: 23

Check size: $500k – $2m

Notable investments: Spiffy, ServiceTrade

Founders/Key People: Jason Caplain, Michael Lee

Website: https://www.bcvp.com

- Big Basin Capital

Big Basin Capital is a venture capital firm located in Silicon Valley, primarily investing in early-stage startups in South Korea and the United States. The firm strongly focuses on Korean startups, leveraging the country’s rapidly growing tech environment and highly-educated talent pool. They often act as the first institutional investor in a startup and are known to lead deals or co-invest with other VCs. The firm’s investment strategy also includes board participation to provide hands-on guidance and assistance to its portfolio companies.

Headquarters: USA

Investment Geography: USA, France, South Korea, Singapore

Operating since: 2013

Stages: Seed, Series A

Investment Focus: Consumer Services, DTC, E-commerce, FoodTech, Digital Media, EdTech, Enterprise Software, Logistics, HR, BioTech

Number of investments: 81

Number of exits: 11

Check size: $500k – $2m

Notable investments: GoodTime.io, GOPIZZA,

Founders/Key People: Phil K. Yoon, Taekkyung Lee

Website: https://www.bigbasincapital.com

- Blackbird Ventures

Since its inception in 2012, Blackbird has demonstrated a strong commitment to supporting startups throughout their journey from idea to beyond IPO. The firm’s portfolio is notable, worth over $7 billion, and includes some of the most successful startups from Australia and New Zealand, such as Canva, Zoox, SafetyCulture, and Culture Amp. Blackbird Ventures focuses on backing generational ambition with generational belief, a philosophy that extends to its approach to investment. They have backed over 100 companies across Australia and New Zealand, with 20% now worth over $100 million and six valued at over $1 billion.

Headquarters: Australia

Investment Geography: USA, New Zealand, UK, Hong Kong

Operating since: 2012

Stages: Pre-Seed, Seed, Series A, Series B

Investment Focus: Consumer Tech, Consumer Brands, D2C, FoodTech, AgTech, FinTech, Crypto, EdTech, E-commerce, Marketplace, Enterprise Software, Cloud, HRTech, MarTech, RetailTech, CyberSecurity, Databases, Synthetic Biology, BioTech, MedTech, Digital Health, HealthTech, Robotics, IoT, Autonomous, SpaceTech, Semiconductors, Solar

Number of investments: 246

Number of exits: 23

Check size: $25k – $5m

Notable investments: Canva, Zoox

Founders/Key People: Alex Gifford, James Palmer

Website: https://www.blackbird.vc

- BLH Venture Partners

BLH Venture Partners, established in 2009, is a venture capital firm based in Atlanta, Georgia. The firm primarily targets investments in sectors such as consumer internet, technology-enabled services, digital media, e-commerce, enterprise technology, and software. They focus on partnering with smart entrepreneurs with relevant experience, keen insights, or deep relationships within growing markets. The firm has been active in the industry for over 14 years, specializing in venture capital and private equity, focusing on investment management and fund operators.

Headquarters: USA

Investment Geography: USA

Operating since: 2009

Stages: Seed, Series A, Series B

Investment Focus: Tech-enabled Services, Enterprise IT, Enterprise Software, CyberSecurity, SaaS, Consumer Internet/E-commerce

Number of investments: 62

Number of exits: 22

Check size: $500k – $15m

Notable investments: BetterCloud, CallRail, Vonage

Founders/Key People: Billy L. Harbert, Ashish H. Mistry

Website: https://www.blhventures.com

- Bond Capital

Bond Capital is a venture capital firm that specializes in supporting visionary founders throughout the entire lifecycle of innovation and growth. The firm’s general partners, including notable figures like Mary Meeker, have a “sweet spot” investment range of around $8.0 million. Bond Capital focuses on various sectors, including consumer internet, digital health, enterprise applications, and social networks. This range demonstrates the firm’s versatility and commitment to nurturing startups across different stages and industries.

Headquarters: USA

Investment Geography: USA, UK, Germany, Canada, Sweden, France, South Korea, Australia, Mexico, Turkey, China, Ireland, India, Netherlands, Uruguay, Algeria

Operating since: 2018

Stages: Series B, Series C, Series D, Series E

Investment Focus: Enterprise Software, SaaS, AI/ML, Automation, Consumer Internet, FinTech, InsurTech, EdTech, E-commerce, Aerospace, Robotics

Number of investments: 116

Number of exits: 13

Check size: $100k – $25m

Notable investments: Canva, Slack, Airbnb, Snap

Founders/Key People: Jesse Ellingworth, Juliet Baubigny, Daegwon Chae

Website: https://www.bondcap.com

- Bonfire Ventures

Bonfire Ventures is a venture capital firm that leads seed-stage investments in B2B software startups. Bonfire Ventures seeks companies with over $250K in annual recurring revenue and a clear path to $100 million ARR. They prioritize startups with a differentiated product that is essential for key business processes and invest in about 8-12 companies per year.

Headquarters: USA

Investment Geography: USA, UK, Israel, Germany, Canada, Netherlands, Mauritius, Brazil, China

Operating since: 2017

Stages: Seed, Series A

Investment Focus: Enterprise SaaS/B2B Software (Digital Security, Finance Technology, Future of Health, Future of Work, Horizontal Solutions, Marketing & E-commerce, Marketplaces, R&D Ops & Infrastructure, Transportation & Logistics, Vertical Cloud)

Number of investments: 189

Number of exits: 52

Check size: $2m – $10m

Notable investments: Figment, Invoca

Founders/Key People: Brett Queener, Jim Andelman

Website:https://www.bonfirevc.com

- Bessemer Venture Partners

Bessemer Venture Partners (BVP) is a globally recognized venture capital firm with a rich history and a diverse investment portfolio. The firm has a broad focus, supporting founders and CEOs from their early days through every growth stage in sectors like AI, cybersecurity, and fintech. BVP has made significant strides in the venture capital space, being involved in over 135 IPOs and a portfolio of 200 companies, including notable names like Pinterest, Shopify, Twilio, and Yelp. The firm manages assets exceeding $20 billion.

Headquarters: USA

Investment Geography: USA, UK, France, Netherlands, Germany, Belgium, India, Canada, China, Australia, South Korea, Spain, New Zealand, Lithuania, Russia, Hong Kong, Norway, Switzerland, Italy, Singapore, Brazil, Tanzania, Poland, Sri Lanka, Sweden, Romania, Denmark, Slovakia, Finland, Argentina, Guernsey, Malaysia

Operating since: 1911

Stages: Seed, Series A, Series B, Series C

Investment Focus: Mobile, SaaS, Enterprise Software, Cloud, HealthCare, Digital Health, E-commerce, CyberSecurity, Consumer, FinTech, Marketplace

Number of investments: 1,704

Number of exits: 638

Check size: $500k – $50m

Notable investments: Twilio, Shopify, LinkedIn

Founders/Key People: Kent Bennett, Mary D’Onofrio

Website: https://www.bvp.com

- Cento Ventures

Cento Ventures is a venture capital firm based in Singapore that was established in 2011. This firm specializes in investing in Southeast Asian digital and technology sectors, particularly Malaysia, Thailand, Singapore, Indonesia, the Philippines, and Vietnam. Known for its focus on under-invested emerging digital markets, Cento Ventures seeks companies that blend local insights with proven digital business models. The firm typically invests in Series A startups with 1-2 years of operating experience in Southeast Asia’s emerging markets.

Headquarters: Singapore

Investment Geography: Singapore, Thailand, Malaysia, UK, USA, Vietnam, Indonesia, Philippines

Operating since: 2011

Stages: Series A, Series B

Investment Focus: Enterprise Software, AI, FinTech, InsurTech, E-commerce, Fashion, RetailTech, Digital Consumer Services, Consumer Internet, FoodTech, AdTech, JobTech, Digital Media, Digital Entertainment, Marketplaces

Number of investments: 39

Number of exits: 13

Check size: $5m – $10m

Notable investments: Pomelo, Foodpanda

Founders/Key People: Lee Buckerfield, Ali Fancy

Website: https://www.cento.vc

- Cleo Capital

Cleo Capital, established in 2018, is based in California. The firm focuses on seed-stage venture capital investments, primarily in technology and technology-enabled sectors. Cleo Capital typically invests in pre-seed and seed rounds, focusing on under-represented founders, fintech, consumer, and enterprise sectors. The firm operates mainly in the USA, with smaller investments in Canada and India.

Headquarters: USA

Investment Geography: USA, Canada, India

Operating since: 2018

Stages: Pre-Seed, Seed

Investment Focus: Female Founders (Consumer Products, D2C, E-commerce, Fashion, Beauty, Luxury, FoodTech, Digital Media, FinTech, Digital Health, Enterprise Software, AI, ML, Hardware, Infrastructure, Cloud Computing, PropTech, Health Care, BioTech)

Number of investments: 105

Number of exits: 13

Check size: $100k – $1m

Notable investments: MasterClass, Groq, Modern Treasury

Founders/Key People: Sarah Kunst, Genalin Setarios

Website: https://www.cleocap.com

- Lool Ventures

Lool Ventures, founded in 2012, is a prominent venture capital firm based in Tel Aviv, Israel. The firm is dedicated to supporting Israel’s best founders from the seed to scale stages, providing guidance, support, and capital to help transform their innovative ideas into successful companies. Lool Ventures is known for its significant involvement in the Information Technology and Artificial Intelligence sectors. The firm’s peak activity was in 2015, with significant exits recorded in 2018.

Headquarters: Israel

Investment Geography: United States, Israel, Canada, Switzerland, United Kingdom.

Operating since: 2011

Investment Focus: Digital Space, AI, Deep Learning, IoT,Digital Health, Robotics, Internet, E-commerce,Mobile,Food,Fashion,IT,Enterprise Software,MarTech,AR/VR,Digital Media, FinTech, Mobility,Cyber Security,Real Estate,LegalTech,EdTech,HRTech,Marketplaces.

Stages: Pre-Seed, Seed, Series A.

Number of investments: 78

Number of exits: 9

Check size: $500K – $2.5M

Notable investments: Beewise, Flip.

Founders/Key People: Avichay Nissenbaum, Yaniv Golan

Website: https://www.lool.vc

- Loyal VC

Loyal VC is a global early-stage investment firm founded in 2018. The firm has made over 100 investments in more than 30 countries. It is supported by a team of over five investing professionals and 250 expert advisors distributed globally across various industries and functions. Notably, 35% of Loyal’s portfolio companies have a female CEO, and about 45% feature a woman in a leadership role, reflecting the firm’s commitment to diversity and an investment approach that prioritizes company performance over pitches.

Headquarters: Canada

Investment Geography: Canada, United Kingdom, United States, Singapore, Australia, India, Netherlands, Hong Kong, Egypt, Germany, Taiwan, Israel.

Operating since: 2018

Investment Focus: Consumer Internet, FinTech,EdTech,FoodTech,E-commerce,Enterprise Software/SaaS,MarTech,Cyber Security,Media,Gaming.

Stages: Pre-Seed, Seed.

Number of investments: 174

Number of exits: 1

Check size: $10K – $200K

Notable investments: DaDa, Mytm.

Founders/Key People: Kamal Hassan, Michael Kosic.

Website: https://www.loyal.vc

- Madrona Venture Group

Madrona Venture Group, founded in 1995, is a venture capital firm based in Seattle, Washington. Specializing in seed, startup, Series A, and early-stage investments, Madrona Venture Group has a particular focus on information technology and infrastructure sectors. The firm invests in early- to late-stage companies, primarily in the Pacific Northwest but also beyond this region. Madrona has a history of supporting innovative technology companies and has been actively involved in the growth of the tech ecosystem in its operating regions.

Headquarters: USA

Investment Geography: United States, Canada, France, Türkiye, Australia, Spain, Czech Republic, China, Israel.

Operating since: 1995

Investment Focus: Adtech, Apps, Data & Analytics, Infrastructure, Martech, ML & Intelligent Apps, Networking/Storage, SaaS/Cloud, Tech-enabled Services), Consumer (Apps, Digital Media, E-commerce, Gaming, Marketplaces, Mobile, Social)

Stages: Pre-seed, Seed, Series A, Series B.

Number of investments: 583

Number of exits: 117

Check size: $1M – $10M

Notable investments: Amazon, UiPath.

Founders/Key People: Tim Porter, Loren Alhadeff

Website: https://www.madrona.com

- Mark VC

Mark VC, established in 2017, is an early-stage venture capital firm based in Austin, Texas, with a presence in Bellaire, Texas. The firm is known for its opportunistic investment approach across a diverse range of industries. They have invested in various sectors including healthcare, security & defense, consumer products, and software-as-a-service (SaaS).

Headquarters: USA

Investment Geography: USA.

Operating since: 2006.

Investment Focus: Consumer Internet, Digital Media, Consumer Packaged Goods, Enterprise Software, Marketplaces, E-commerce.

Stages: Pre-seed, Seed, Post-Seed, Series A, Series B.

Number of investments: 9

Number of exits: 2

Check size: $500K – $5M

Notable investments: Andela, ZenBusiness

Founders/Key People: Adam Zeplain

Website: https://www.markvc.com/

- Matchstick Ventures

Matchstick Ventures, founded in 2013, is a venture capital firm that operates with a focus on early-stage technology investments. The firm primarily targets the North and Rockies regions, seeking to be the most impactful early-stage technology investor in these areas. Matchstick Ventures invests in startups at the seed and early stages, with an emphasis on innovative ideas, large markets, and diverse founders.

Headquarters: USA

Investment Geography: USA, Canada, India, Brazil.

Operating since: 2015.

Investment Focus: Consumer Internet, FinTech, E-commerce, Digital Health, SaaS/Software, B2B/Enterprise, AI & Data Analytics, CyberSecurity.

Stage: Pre-Seed, Seed, Post-Seed, Series A, Series B.

Number of investments: 141

Number of exits: 11

Check size: $10K – $1M

Notable investments: Branch App, Nextbite.

Founders/Key People: Ryan Broshar, Natty Zola

Website: https://www.matchstick.vc/

- MATH Venture Partners

MATH Venture Partners, founded in 2014, is a venture capital firm based in Chicago, Illinois. The firm specializes in early to middle-stage funding, focusing on digital and technical companies. MATH Venture Partners invests in teams that have a unique advantage in customer acquisition, and they target a range of industries. The firm prides itself on its operational expertise, having collectively built and scaled businesses worth over $7 billion.

Headquarters: USA

Investment Geography: USA, UK, Denmark, Canada.

Operating since: 2015.

Investment Focus: SaaS/Software, Data Analytics, Marketplaces, E-commerce, Consumer, Enterprise/B2B.

Stage: Pre-Seed, Seed, Post-Seed, Series A, Series B.

Number of investments: 63

Number of exits: 12

Check size: $100K – $2M

Notable investments: Acorns, LogicGate.

Founders/Key People: Mark Achler, Dana Wright

Website: https://www.mathventurepartners.com

- Matrix Partners

Matrix Partners, established in 1977, is a U.S.-based private equity investment firm with a strong focus on venture capital investments. Headquartered in San Francisco, California, the firm primarily invests in seed and early-stage companies in the United States and India. The firm has made significant contributions to the venture capital landscape, supporting innovative startups and early-stage companies in various technology-driven fields.

Headquarters: USA

Investment Geography: United States, China, India, Singapore, Canada, United Kingdom, Hong Kong, Israel, Australia, France, Estonia, Denmark

Operating since: 1977

Investment Focus: Consumer Tech, SaaS, Mobile, Hardware, E-commerce, Fashion, FoodTech, FinTech, Digital Media, PropTech, Mobility, Marketplaces, Enterprise Tech, Infrastructure, Enterprise Software, AI, Big Data, Data Analytics, CyberSecurity, Telecom, Semiconductors, Wireless, HRTech

Stage: Pre-Seed, Seed, Post-Seed, Series A, Series B+

Number of investments: 896

Number of exits: 177

Check size: $100K – $50M

Notable investments: Apple, Canva

Founders/Key People: Mark McDonnell, Anthony Papalia

Website: https://www.matrix.vc

- Maverick Ventures

Maverick Ventures, founded in 2015, is a San Francisco-based venture capital firm. It operates as the venture arm of Maverick Capital, a hedge fund. Maverick Ventures specializes in investing in early-stage companies within the healthcare and technology sectors. By collaborating with Maverick Ventures, entrepreneurs gain access to the expertise of a dedicated team of venture partners and the resources, reputation, and extensive network of a multi-billion dollar investment firm. Maverick Capital has been actively investing in early-stage companies for over two decades, emphasizing the depth of experience and market understanding that the venture arm brings to its investments.

Headquarters: USA

Investment Geography: United States, Israel, India, South Korea, China, Mexico, Ireland, Singapore, Switzerland, Denmark, United Kingdom, Canada.

Operating since: 1993.

Investment Focus: Digital Health & Wellness,Health Care/HealthTech/BioTech/MedTech ,Enterprise/B2B,AI/ML,SaaS/Software,Cyber Security, MarTech, HRTech, Consumer Tech/Consumer Internet,E-commerce,Marketplaces.

Stage: Pre-Seed, Seed, Post-Seed, Series A, Series B+.

Number of investments: 183

Number of exits: 35

Check size: $1M – $10M

Notable investments: Coupang, ConcertAI

Founders/Key People: Stephanie Mabunga, Richard Olson

Website: https://www.maverickventures.com/

- Mayfield Fund

Mayfield, also known as Mayfield Fund, is a distinguished venture capital firm based in the United States, particularly in Menlo Park, California. Established in 1969, it stands as one of Silicon Valley’s oldest venture capital firms. Mayfield specializes in early-stage to growth-stage investments, focusing primarily on enterprise and consumer technology companies. The firm takes a people-first approach in its investments, partnering with founders from inception to build multi-billion dollar companies.

Headquarters: USA

Investment Geography: United States, India, China, United Kingdom, Australia, Israel, Singapore, France, Taiwan, Uruguay, Canada, Tonga.

Operating since: 1969.

Investment Focus: Enterprise/B2B (Software/SaaS,Cloud/Infrastructure/Data,AI/ML,MarTech, Cyber Security,HRTech, Telecom/Hardware), Consumer (Consumer Internet,E-commerce, FinTech, Media/Entertainment, AR/VR, Health & Fitness,Mobility), Engineering Biology (BioTech/Digital Health/HealthTech).

Stage: Pre-Seed, Seed, Post-Seed, Series A, Series B+.

Number of investments: 1039

Number of exits: 246

Check size: $100K – $50M

Notable investments: Lyft, Marketo

Founders/Key People: Navin Chaddha, Guru Pangal

Website: https://www.mayfield.com

- Molten Ventures

Molten Ventures, previously known as Draper Esprit, is a leading venture capital firm based in London, United Kingdom. Founded in 2006, the firm specializes in investing in and developing high-growth digital technology businesses. The firm invests in the European technology sector and has a diverse portfolio of around 70 investee companies.

Headquarters: UK

Investment Geography: United Kingdom, United States, Germany, Ireland, France, Finland, Sweden, Netherlands, Belgium, Switzerland, Türkiye, Czech Republic.

Operating since: 2006.

Investment Focus: Enterprise Software, SaaS, FinTech,MarTech,Semiconductors,Digital Health, Digital Media, E-commerce, Consumer, Hardware, Gaming, Sports, Energy, CyberSecurity, Travel, LegalTech, FoodTech, HRTech, DeepTech.

Stage: Seed, Post-Seed, Series A, Series B+.

Number of investments: 301

Number of exits: 54

Check size: $300K – $3M.

Notable investments: Revolut, Box

Founders/Key People: Martin Davis, David Cummings

Website: https://www.moltenventures.com/

- Moneta Ventures

Moneta Venture Capital, founded in 2014, is a venture capital firm based in Tel Aviv, Israel. The firm is known for its active involvement in the FinTech, InsurTech, and Financial related investments sectors. Moneta Venture Capital has a strong focus on early-stage companies, particularly in business-to-business enterprise software operating in healthcare, education, finance, and other domains, primarily across the United States’ West Coast and Texas.

Headquarters: Israel

Investment Geography: Israel, USA, UK

Operating since: 2015.

Investment Focus: FinTech, InsurTech (Big Data, AI, ML, NLP, Blockchain, Cloud, Enterprise Software – Credit Risk, Capital Markets, Tax, Fraud, Churn, Payments).

Stage: Seed, Post-Seed, Series A, Series B+.

Number of investments: 40

Number of exits: 5

Check size: $500K – $5M

Notable investments: Insurify, TipRanks

Founders/Key People: Meirav Harnoy, Adoram Gaash

Website: https://www.monetavc.com

- Moonshots Capital

Moonshots Capital, established in 2014, is a seed-stage venture capital firm based in Marina del Rey, California, with a regional office in Austin, Texas. The firm focuses on investing in technology startups, particularly those founded by military veterans. Moonshots Capital has a broad investment spectrum, including sectors like mobile, artificial intelligence, SaaS, cybersecurity, finance, gaming, transportation, and wearables.

Headquarters: USA

Investment Geography: USA, Singapore

Operating since: 2014.

Investment Focus: Consumer Internet,Consumer Goods, Mobile, E-commerce, FinTech, EdTech, Digital Health,BioTech,PropTech,Enterprise Software,SaaS,Cyber Security, B2B Services.

Stage: Seed, Post-Seed, Series A, Series B+.

Number of investments: 144

Number of exits: 16

Check size: $500K – $3M

Notable investments: LinkedIn, Slack

Founders/Key People: Kelly Perdew

Website: https://www.moonshotscapital.com

- Mosaic Ventures

Mosaic Ventures, founded in 2014, is a venture capital firm based in London focused on investing across Europe. The firm primarily invests in early-stage companies, particularly in Series A funding rounds. This firm has been instrumental in funding innovative startups and has a track record of actively seeking new investment opportunities.

Headquarters: UK

Investment Geography: United Kingdom, United States, Germany, France, Israel, Ireland, Lithuania, Canada, Sweden, Estonia, Netherlands.

Operating since: 2014.

Investment Focus: Machine Intelligence/AI, Future of Money/FinTech, Edge Applications, Computing, Work OS/Future of Work, Human Empowerment, HealthTech, EdTech/Software, Open Bazaars/Commerce/E-commerce, Consumer/B2B

Stage: Seed, Post-Seed, Series A, Series B+.

Number of investments: 86

Number of exits: 23

Check size: $1M – $10M

Notable investments: Blockchain.com, Five9

Founders/Key People: Toby Coppel, Simone Levene

Website: https://www.mosaicventures.com

- Mucker Capital

Mucker Capital, founded in 2011, is a venture capital firm headquartered in Santa Monica, California. The firm primarily focuses on investing in seed-stage and early-stage companies operating within the software and technology sectors. Mucker Capital is known for investing in internet software, services, and media, particularly on defensible and scalable businesses. The firm also operates MuckerLab, which serves as an acceleration platform for its investment activities.

Headquarters: USA

Investment Geography: United States, Canada, Mexico, Taiwan, United Kingdom, Poland, Kuwait, Panama, France, Singapore.

Operating since: 2011.

Investment Focus: Consumer Internet, FinTech, E-commerce, EdTech, Digital Health/HealthTech, Digital Media/Gaming, Enterprise/B2B, SaaS/Software, MarTech, CyberSecurity, HRTech, PropTech.

Stage: Seed, Post-Seed, Series A.

Number of investments: 256

Number of exits: 18

Check size: $100K – $3M

Notable investments: ServiceTitan, Honey

Founders/Key People: William Hsu, Erik Rannala

Website: https://www.mucker.com

- New Ground Ventures

New Ground Ventures is a venture capital firm known for its active role in early-stage investments. Founded in 2013 and based in Palo Alto, California, the firm has a significant footprint in the venture capital space. It operates as an investment platform, offering both funding and support to its portfolio companies.

Headquarters: USA

Investment Geography: United States, Australia, Canada, Germany

Operating since: 2013

Investment Focus: EdTech, FinTech, FoodTech, Consumer Brands, E-commerce, Digital Health/BioTech/Medical Devices, Enterprise/B2B, Software/SaaS, Future of Work, DeepTech/Robotics/Hardware.

Stage: Seed, Post-Seed, Series A, Series B.

Number of investments: 63

Number of exits: 17

Check size: $1M – $5M

Notable investments: Petal, YFood Labs

Founders/Key People: Suzy Wolfson

Website: https://www.newground.vc

- Nuwa Capital

Nuwa Capital, founded in 2020, is a venture capital firm based in Dubai, United Arab Emirates. The firm focuses on early-stage investments, particularly in technology and healthcare companies in the Middle East and North Africa region.

The firm is known for its radical investment approach, aiming to reshape the relationship between founders and capital. By providing capital, guidance, and access to a network of investors and strategic partners, Nuwa Capital supports the growth and development of its portfolio companies.

Headquarters: UAE

Investment Geography: United Arab Emirates, Saudi Arabia, Egypt, Türkiye, United States, Bahrain, Pakistan, Kenya, Singapore.

Operating since: 2020.

Investment Focus: FinTech, E-commerce & Marketplaces, Direct-to-Consumer Brands, SaaS/Software, B2B/Enterprise, EdTech, HealthTech, AgTech.

Stage: Seed, Post-Seed, Series A, Series B.

Number of investments: 30

Number of exits: 0

Check size: $250K – $7M

Notable investments: Homzmart, Eyewa

Founders/Key People: Stephanie Prince, Khaled Talhouni

Website: https://www.nuwacapital.io

CyberAgent Capital

CyberAgent Capital operates several funds, each focusing on different geographical regions and investment stages. They have multiple funds for investments in Japan, China, and Southeast Asia. The fund sizes vary, with examples including ¥6,000,000,000 for the CA Startups Internet Fund 3, L.P. in Japan and US$19.0 million for the CA-JAIC China Internet Fund Ⅱ, L.P.

Headquarters: Japan

Investment Geography: Japan, USA, Vietnam, Indonesia, China, Thailand, South Korea, Singapore, Taiwan, Hong Kong, Malaysia, Canada, Australia

Operating since: 2006

Stages: Seed,Series A

Investment Focus: Internet (Enterprise Software,MarTech,FinTech,Digital Media, EdTech, Gaming, FoodTech,JobTech,TravelTech,Digital Health, HealthTech, Social, PropTech, E-commerce, Marketplaces, IoT,Blockchain,Logistics,Mobility)

Number of investments: 396

Number of exits: 144

Check size: $100k – $5m

Notable investments: VNG, Tokopedia

Founders/Key People: Nguyen Tuan, Takashi Kitao

Website: https://www.cyberagentcapital.com/en/

Data Point Capital

Data Point Capital is a venture capital firm primarily focused on the Internet sector. Based in Boston, Massachusetts, the firm comprises business executives and internet leaders with substantial experience in creating value by developing successful companies. They operate with a philosophy of being entrepreneurs who assist other entrepreneurs. Data Point Capital has been involved in building numerous successful ventures, leveraging their expertise to foster growth and innovation in internet-focused startups.

Headquarters: USA

Investment Geography: USA, India, Greece

Operating since: 2012

Stages: Seed,Series A

Investment Focus: Consumer Internet (E-commerce,Mobile,Media),Enterprise Software,Cyber Security,AdTech,MarTech,JobTech,HRTech,eSports,FoodTech,IIoT,Marketplaces

Number of investments: 51

Number of exits: 13

Check size: $100k – $3m

Notable investments: FlexCar, JobGet

Founders/Key People: Geoff Oblak, Scott Savitz,

Website: https://datapointcapital.com

Dawn Capital

Dawn Capital is a venture capital firm based in London specializing in B2B software investments. They are known for their deep expertise in helping B2B founders build category-defining companies. Dawn Capital partners with businesses from Series A to exit, contributing significantly to their portfolio companies growth and scaling. The firm comprises a team of investors, entrepreneurs, strategists, and operational specialists who share a passion for advancing B2B ventures.

Headquarters: UK