The 10-Point Fundraising Checklist by Jason Calacanis (Early Investor in Uber, Calm)

Jason Calacanis is one of Silicon Valley’s most successful angel investors. His LAUNCH fund has invested in 300+ startups, including Uber, Calm, and Stripe. He also co-hosts the popular “All In” podcast.

In The SaaS Operator newsletter from 20th February 2024, you’ll learn:

- Tips for finding the right investors.

- Jason’s rules for pitching your startup effectively.

- How to set your startup’s valuation before a fundraising round.

Jason created a 100-point founder checklist to help founders get funding for their startups. We dug up 10 key points for founders preparing to raise funds. 👇🏽

#1 Calculating your burn rate and runway

Your startup's lifeblood is in two numbers: Burn Rate and Runway. Your burn rate will let you know how much runway you have, and that’ll let you know how much you need to raise.

Burn Rate is how fast your business is losing cash.

Burn Rate = Revenue – Spend. Calculate your average burn rate over three months for clarity.

Runway is how long your business can last before cash dries up.

Runway = Amount raised ÷ Burn rate. It's calculated in months. So if you raise $200k and have a burn rate of $20k monthly, your runway is 10 months.

#2 Allocating equity to early hires

- Third co-founder: ~10%

- VP (Sales/Marketing): ~1-2%

- Senior Engineers: ~0.7%-1%

- Mid-Level Engineer: ~0.45%

- Junior Engineer: ~0.15%

- Junior Business Hire: ~0.05%

#3 Planning your runway

Aim to raise enough cash to last 18 to 24 months. Too little will force you to start fundraising again too fast. Raise too much (3-5 years runway), and you'll give away too much of your company too soon.

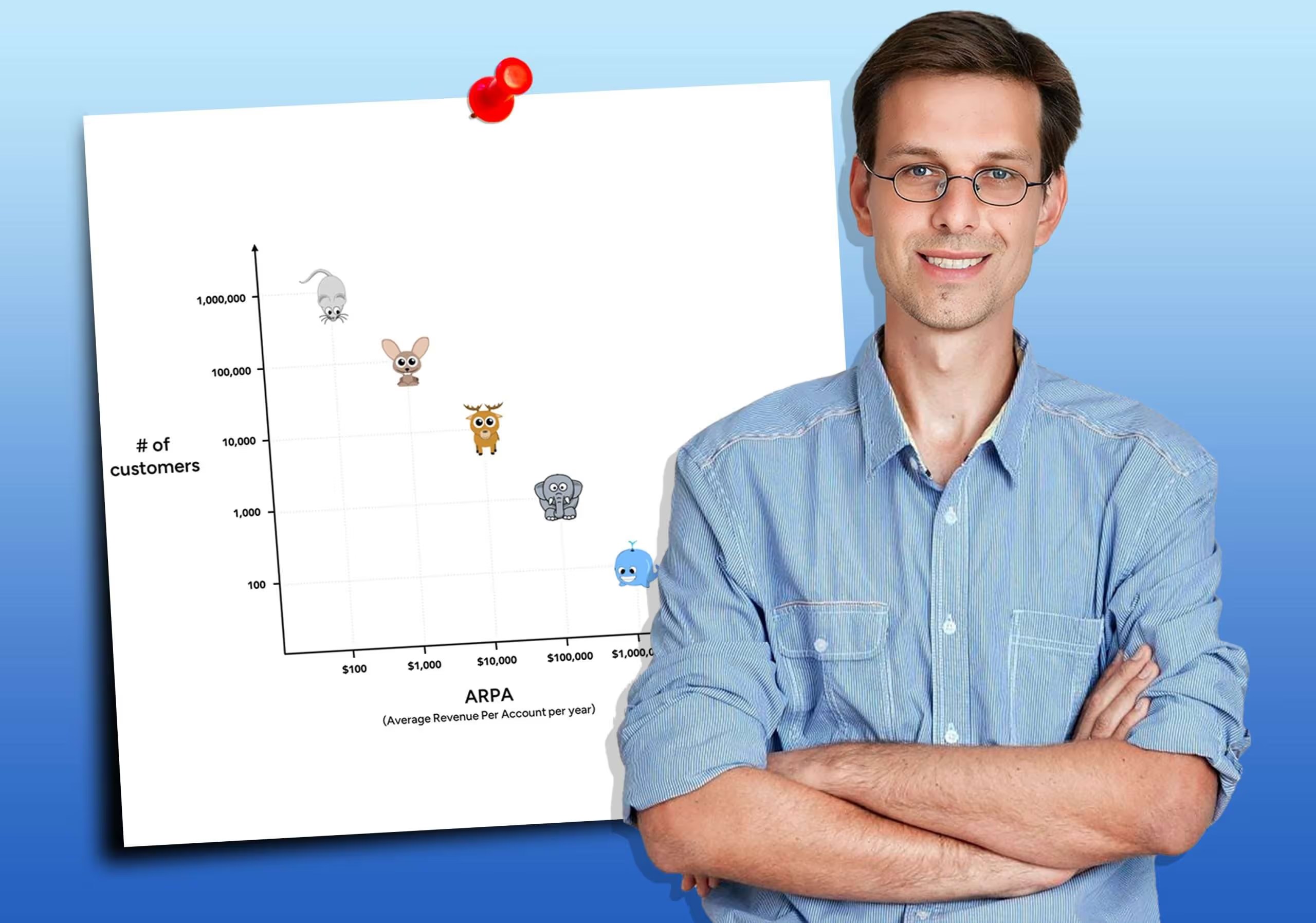

#4 Valuing your startup

The market generally determines valuation. But if you land a lead investor, they set the terms. If you go the party round route, you set the terms.

Those days of crazy valuations during post-COVID are gone.

Today, the average pre-funding valuation is around $45 million for series A and $10-14 million for seed rounds (Carta 2023). Valuations are higher if you’re in a trendy vertical or an entrepreneur with past success.

#5 Finding investors

Target investors aligned with your startup's stage, industry, and location, but avoid investors of direct competitors.

Decode how investors partake in rounds: some prefer to lead, some follow, and some do both. Dig into each investor's past investments, LinkedIn, and blogs.

Use sites like Crunchbase, Pitchbook, and NFX Signal for your homework.

When you find the right investors, research when they raised their last funds. If they've recently announced a new fund, they're looking to invest.

#6 Vetting potential investors

Vet VCs to know how valuable they are as partners. Talk to other founders in their portfolio. Find out if a VC firm truly adds value. All investors are different; some just write the check and are hands-off. Others offer crucial expertise like legal or sales.

#7 Pitching your startup

Jason's "Perfect cold email" template:

- Keep emails short and to the point.

- Start with a 1-2 sentence personalized intro.

- Add key stats: your user count, revenue model, and the last 3 months' revenue.

- Show, don't tell – a quick Loom demo and some solid charts do the trick.

Jason’s rules for pitching:

- Get to your product in 15 seconds.

- Provide actual user examples.

- Sync your talk with your slides.

- Show real results. Avoid lots of text and cut the jargon.

- Involve your team. Sales shapes the sales slides, Engineering beefs up the product slides.

#8 Nailing your first meeting

- Have a short 5-min pitch deck and a detailed 15-min one ready. Add an appendix for extra details.

- Always let the investor pick: quick demo or deep dive?

- Nail investor questions accurately- no fluff.

End the meeting with clear next steps. Ask, "What's needed for you to invest?"

Address their concerns from the question above before the post-meeting follow-up.

#9 Keeping a low-burn culture

Raising VC money is harder nowadays, so every dollar saved is a dollar for growth. Be frugal, but not cheap.

Examples of cheap: Losing top employees over pennies. Being super tight with giving early employees equity.

Examples of frugal: Watching your cash flow like a hawk. Ditching flashy expenses like swanky offices and catered lunches. Using free tools where you can. Negotiating vendor contracts. Reinvesting savings into your product.

#10 Sending a great investor update

Regularly update your investors. Monthly for current investors, weekly for those you're trying to convince. Have one update for current investors and another for potential investors, in case you don’t want to disclose certain info yet. Show your numbers – MOM growth, revenue, expenses, and runway.

This 10-point checklist can boost your chances of finding the perfect investors who will give you the needed funding and guidance for your startup. Who knows, you might be the next unicorn!